Linking Aadhaar to PAN – Income Tax Notification

Linking Aadhaar to PAN – Procedure of intimating AADHAAR number to Income Tax Department by (PAN) holder and quoting of the same in PAN applications

Linking Aadhaar to PAN CBDT Notification

F.No. DGET(S)/DIT(S)-1/Aadhaar Seeding/0005/2015/Part 6

GOVERNMENT OF INDIA

CENTRAL BOARD OF DIRECT TAXES

DIRECTORATE OF INCOME-TAX(SYSTEMS)

Notification 7 of 2017

New Delhi, 29th June 2017

Subject :-Procedure of intimating AADHAAR number to Income Tax Department by Permanent Account Number(PAN) holder and quoting of the same in PAN applications in compliance of Section 139AA of Income Tax Act.

Sub-rule (5) and (6) to rule 114 of Income Tax Rules, 1962 notified vide notification G.S.R. No. 642(E) dated 27.6.2017, states that:-

“(5) Every person who has been allotted permanent account number as on the 1St day of July, 2017 and who in accordance with the provisions of sub-section (2) of section 139AA is required to intimate his Aadhaar number, shall intimate his Aadhaar number to the Principal Director General of Income-tax(Systems) or Director General of Income-tax(Systems) or the persons authorized by the said authorities.

(6) The Principal Director General of Income-tax(Systems) or Director General of Income-tax

(Systems) shall specify the formats and standards along with procedure, for the verification of documents filed with the application in sub-rule(4) or intimation of the Aadhaar number in sub-rule (5), for ensuring secure capture and transmission of data in such format and standards and shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relating to furnishing of the application forms for allotment of permanent account number and intimation of Aadhaar number.”

2.In exercise of the powers delegated by the Central Board of Direct Taxes vide above notification G.S.R. No. 642(E) dated 27.6.2017, the authority for intimating Aadhaar number, formats and standards along with procedure, for the verification of documents filed with the application in sub-rule(4) or intimation of the Aadhaar number in sub-rule (5) of Rule 114 of Income Tax Rules, 1962, format and standards for ensuring secure capture and transmission of data, appropriate security, archival and retrieval policies in relation to furnishing of the application forms for allotment of permanent account number and intimation of Aadhaar number will be as follows:-

A. For intimating Aadhaar number by existing PAN holders:-

| S. No. | Authority to whom Aadhaar number is to be not informed | Mode | Manner through which Aadhaar has to be informed | Whether any fee is levied or not |

| (i). | Either of the PAN service providers namely M/s NSDL e-governance Infrastructure Limited (NSDL/eGov) or M/s UTI Infrastructure Technology And Services Limited(UTIITSL) | SMS | By sending a SMS, in specified format, to specified ‘Short code’ and using specified Keyword which are :-

For Example |

Free service. SMS charges as levied by mobile operator of the PAN holder will apply |

| On-line | By visiting and filling required information, such as PAN, Aadhaar Number, Name as per Aadhaar, Date/Year of Birth etc., through applicable link provided on the websiteof either of PAN service provider i.e. www.tin-nsdl.com for NSDL eGov or www.utiitsl.com for UTIITSL. | Free service. | ||

| Through designated PAN service centre | By visiting designated PAN service centre of PAN service provider NSDL eGov or UTIITSL, PAN holder has to fill prescribed form as provided in Annexure-I which has to be submitted to designated PAN service centre along with copy of PAN card, Aadhaar card and prescribed applicable fee. PAN holder may authenticate Aadhaar Biometrically on visit to such PAN service centre. Biometric authentication shall compulsorily be required in cases where there are. sufficient mismatches in PAN and Aadhaar data. Details of designated PAN service centre shall be published by PAN service providers on their respective websites i.e. www.tin-nsdl.com for Ms NSDL eGov or www.utiitsl.com for M/s UTIITSL. | Paid service. Approved prescribed fee will be levied by PAN service centre on PAN holder who files request for Aadhaar seeding. However, there will not be any additional fee on account of Aadhaar seeding while making new PAN application or Change request. |

||

| (ii) | eFiling system of the Income Tax Department. | On-line | By visiting and filing required information, PAN, Aadhaar Number, Name as per Aadhaar, Date/Year of Birth etc., through applicable link provided on e-filing portal of the Income Tax Department i.e. www.incometaxindiaefiling.gov.in | Free service |

B. For quoting Aadhaar in new PAN application process:-

| (i) Guidelines for filling the Column No. 12 of Form 49A | ||

| Column No. | Column Details | Guidelines for filling the form |

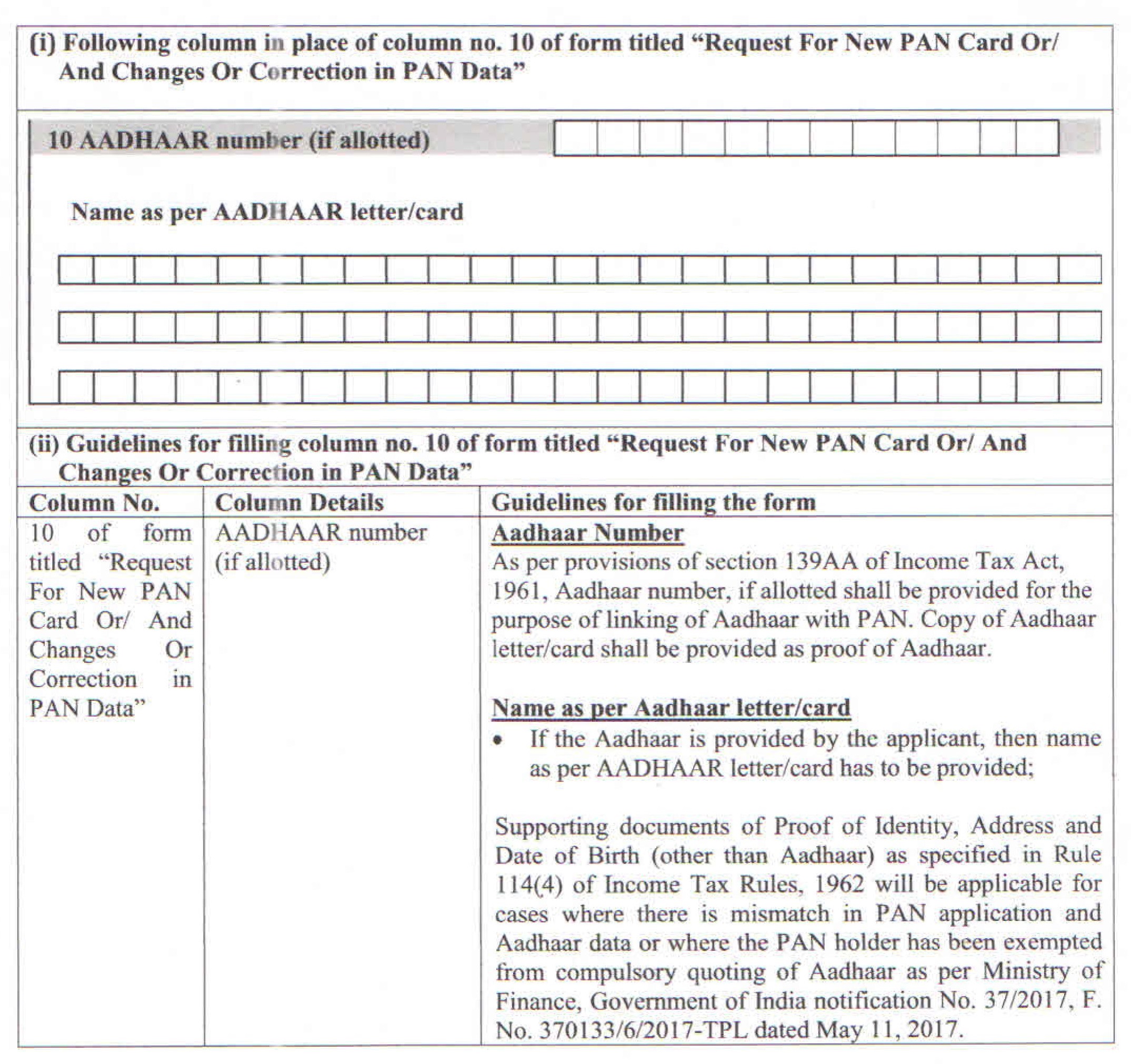

| 12 of Form 49A | In case of a person, who is required to quote Aadhaar number or the Enrolment ID of Aadhaarapplication form as per section 139AA. | Aadhaar Number

As per provisions of section 139AA of Income Tax Act, 1961, Aadhaar number has to be provided. Copy of Aadhaar letter/card shall be provided as proof of Aadhaar. Enrolment ID (EID) of application for Aadhaar Only if Aadhaar is not allotted to the applicant, then ElD (which includes date & time of enrolment) for Aadhaar shall be provided. Copy of EID receipt shall be provided as proof of enrolment.

Supporting documents of Proof of Identity, Address and Date of Birth (other than Aadhaar) as specified in Rule 114(4) of Income Tax Rules, 1962 will be applicable for cases where there is mismatch in PAN application and Aadhaar data or the PAN applicant has provided Aadhaar EID or where the PAN applicant has been exempted from compulsory quoting of Aadhaar as per Ministry of Finance. Government of India notification No. 37/2017, F. No. 370133/6/2017-TPL dated May 11, 2017. |

B. For quoting Aadhaar in new PAN application process:-

| (i) Guidelines for filling the Column No. 12 of Form 49A | ||

| Column No. | Column Details | Guidelines for filling the form |

| 12 of Form 49A | In case of a person, who is required to quote Aadhaar number or the Enrolment ID of Aadhaarapplication form as per section 139AA. | Aadhaar Number As per provisions of section 139AA of Income Tax Act, 1961, Aadhaar number has to be provided. Copy of Aadhaar letter/card shall be provided as proof of Aadhaar. Enrolment ID (EID) of application for Aadhaar Only if Aadhaar is not allotted to the applicant, then ElD (which includes date & time of enrolment) for Aadhaar shall be provided. Copy of EID receipt shall be provided as proof of enrolment. Name as per Aadhaar letter/card or Enrolment ID for Aadhaar application form

Supporting documents of Proof of Identity, Address and Date of Birth (other than Aadhaar) as specified in Rule 114(4) of Income Tax Rules, 1962 will be applicable for cases where there is mismatch in PAN application and Aadhaar data or the PAN applicant has provided Aadhaar EID or where the PAN applicant has been exempted from compulsory quoting of Aadhaar as per Ministry of Finance. Government of India notification No. 37/2017, F. No. 370133/6/2017-TPL dated May 11, 2017. |

C. For quoting Aadhaar in form titled “Request For New PAN Card Or/ And Changes Or Correction in PAN Data”:-

2. Aadhaar number can be informed to the Income Tax Department by the PAN holder/applicant through the authority and procedure mentioned above.

3. Aadhaar shall be linked to PAN after due authentication of Aadhaar from Unique Identification Authority of India (UIDAI) (hereinafter referred to as UlDAI) through available authentication modes i.e. demographic, biometric, OTP, e-KYC or Multi-factor or as specified by the UIDAI. Aadhaar data shall also be matched with PAN/PAN application data before authentication. PAN applications or request for linking of Aadhaar with PAN may be rejected if mismatches in Aadhaar and PAN data are observed.

4. PAN and e-Filing service providers shall ensure that the identity information of Aadhaar holder, Demographic as well as Biometric, is only used for submission to the Central Identities Data Repository of the UlDAl for Aadhaar authentication purpose. However, demographic information of Aadhaar shall also be sent to Income Tax Department for linking with PAN. Any deviation will be treated as non-compliance. to security and confidentiality clause or similar clause of their respective agreements/contracts and may lead to applicable penalty as per their respective agreements/contracts.

(S.K. Chowdhari)

Pr. Director General of Income-tax(Systems)

New Delhi.

Annexure I

Form for Aadhaar seeding into PAN database

| PAN | |||

| NAME AS PER PAN CARD | |||

| AADHAAR NUMBER | |||

| NAME AS PER AADHAAR CARD | |||

|

Declaration: I hereby confirm that the Aadhaar given above has been issued to me by UIDAI and same has not been provided by me earlier for the purpose of seeding with any other PAN. I hereby declare that Ihave not been allotted any other PAN than the one mentioned above by me. I hereby declare that the information furnished above is true to the best of my knowledge and belief. I hereby state that l have no objection in authenticating myself with Aadhaar based authentication system and consent to use my Aadhaar number, Demographic, Biometric and/or One Time Pin (OTP) data for authentication for the purpose of fulfilling the requirement under PAN procedure. I understand that the Demographic, Biometrics and/or OTP I provide for authentication shall be used only for authenticating my identity through the Aadhaar Authentication system for the purpose of seeding of Aadhaar against PAN and for no other purposes. I understand that complete security and confidentiality shall be ensured for my personal identity data provided for the purpose of Aadhaar based authentication. |

|||

| Date: | ______/______/20_______ | Signature/Thumb Impression | |