Income Tax Rates 2015-16 (AY 2016-17)

Rates of Income Tax applicable for the year 2015-16 (Assessment Year 2016-17) applicable for Salaried Employees – Income Tax Circular 20/2015

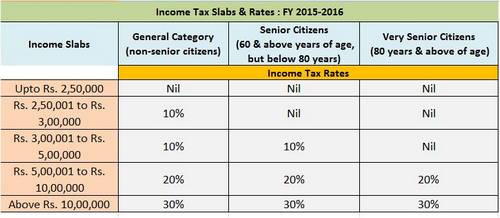

As per the Finance Act, 2015, income-tax is required to be deducted under Section 192 of the Act from income chargeable under the head “Salaries” for the financial year 2015-16 (i.e. Assessment Year 2016-17) at the following rates:

Rates of tax

A. Normal Rates of tax:

|

Sl |

Total Income |

Rate of tax |

|

1 |

Where the total income does not exceed Rs. 2,50,000/-. |

Nil |

|

2 |

Where the total income exceeds Rs. 2,50,000/- but does not exceed Rs. 5,00,000/-. |

10 per cent of the amount by which the total income exceeds Rs. 2,50,000/- |

|

3 |

Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/-. |

Rs. 25,000/- plus 20 per cent of the amount by which the total income exceeds Rs. 5,00,000/-. |

|

4 |

Where the total income exceeds Rs. 10,00,000/-. |

Rs. 1,25,000/- plus 30 per cent of the amount by which the total income exceeds Rs. 10,00,000/- |

B. Rates of tax for every individual, resident in India, who is of the age of sixty years or more but less than eighty years at any time during the financial year:

| Sl No |

Total Income |

Rate of tax |

|

1 |

Where the total income does not exceed Rs. 3,00,000/- |

Nil |

|

2 |

Where the total income exceeds Rs. 3,00,000 but does not exceed Rs. 5,00,000/- |

10 per cent of the amount by which the total income exceeds Rs. 3,00,000/- |

|

3 |

Where the total income exceeds Rs. 5,00,000/- but does not exceed Rs. 10,00,000/- |

Rs. 20,000/- plus 20 per cent of the amount by which the total income exceeds Rs. 5,00,000/-. |

|

4 |

Where the total income exceeds Rs. 10,00,000/- |

Rs. 1,20,000/- plus 30 per cent of the amount by which the total income exceeds Rs. 10,00,000/- |

C. In case of every individual being a resident in India, who is of the age of eighty years or more at any time during the financial year:

| Sl No |

Total Income |

Rate of tax |

|

1 |

Where the total income does not exceed Rs. 5,00,000/- |

Nil |

|

2 |

Where the total income exceeds Rs. 5,00,000 but does not exceed Rs. 10,00,000/- |

20 per cent of the amount by which the total income exceeds Rs. 5,00,000/- |

|

4 |

Where the total income exceeds Rs. 10,00,000/- |

Rs. 1,00,000/- plus 30 per cent of the amount by which the total income exceeds Rs. 10,00,000/- |

Education Cess on Income tax:

The amount of income-tax including the surcharge if any, shall be increased by Education Cess on Income Tax at the rate of two percent of the income-tax.

Secondary and Higher Education Cess on Income-tax:

An additional education cess is chargeable at the rate of one percent of income-tax including the surcharge if any, but not including the Education Cess on income tax.

Check also the following articles for more information on Income Tax 2015-16

[catlist tags=”income-tax-2015-16-salaried-employees” numberposts=10]

Want to Calculate your Income Tax for the Year 2015-16? Use GConnect online income tax calculator

Click here to reach GConnect Income Tax Calculator 2015-16 (with save option)

Click here to reach Instant GConnect Income Tax Calculator 2015-16

Download Income Tax Department Circular No.20/2015 (F.No. 275/192/2015-IT(B) dated 02.12.2015