Income Tax Day 2024 – A Journey of Transformation: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Income Tax Day 2024 – A Journey of Transformation: Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs: FinMin

Ministry of Finance

Celebrating Income Tax Day 2024: A Journey of Transformation

Budget 2024-25 Introduces Enhanced Deductions and Revised Tax Slabs

Posted On: 23 JUL 2024 5:18PM by PIB Delhi

What is Income Tax?

Income tax is a government levy on the income earned by individuals and businesses during a financial year. “Income” encompasses various sources, defined broadly under Section 2(24) of the Income Tax Act. Here’s a simplified breakdown:

- Income from Salary: This includes all payments from an employer to an employee, such as basic pay, allowances, commissions, and retirement benefits.

- Income from House Property: Rental income from residential or commercial properties is taxable.

- Income from Business or Profession: Profits from business or professional activities are taxable after deducting expenses.

- Income from Capital Gains: Profits from selling capital assets like property or jewellery are taxable. These gains can be long-term or short-term.

- Income from Other Sources: This includes income not covered by the other categories, such as savings interest, family pension, gifts, lottery winnings, and investment returns.

Background

Income Tax Day, celebrated on 24th July, marks a significant milestone in India’s fiscal history. This day commemorates the introduction of income tax in India by Sir James Wilson in 1860. While this initial implementation laid the groundwork, it was the comprehensive Income-tax Act of 1922 that truly established a structured tax system in the country. This Act not only formalized various income tax authorities but also laid the foundation for a systematic administration framework.

In 1924, the Central Board of Revenue Act further strengthened this structure by constituting the Board as a statutory body responsible for administering the Income-tax Act. This period saw the appointment of Commissioners of Income-tax for each province, supported by Assistant Commissioners and Income-tax Officers.

The recruitment of Group A officers in 1946 marked another significant development, with initial training conducted in Bombay and Calcutta. The establishment of the I.R.S. (Direct Taxes) Staff College in Nagpur in 1957, later renamed the National Academy of Direct Taxes, further strengthened professional development within the department.

Technological advancements also played a crucial role, with the introduction of computerization in 1981. This initial phase focused on processing challans electronically. Finally, in 2009, the Centralized Processing Centre (CPC) was set up in Bengaluru to handle the bulk processing of e-filed and paper returns, operating efficiently in a jurisdiction-free manner.

Income Tax Day not only honours the historical development of tax administration in India but also highlights the continuous advancements and modernization efforts aimed at creating a more efficient and taxpayer-friendly system.

Importance of Income Tax

Income tax plays a crucial role in nation-building by supporting the fundamental functions of an effective state. It provides the necessary revenue to ensure security, funding essential services like healthcare, education, and infrastructure. These services are vital for the well-being of citizens and the overall development of society. Additionally, the revenue from income tax facilitates economic development by enabling investments in various sectors, promoting growth, and creating job opportunities.

Taxation also influences the balance between wealth accumulation and redistribution, shaping the social character of the state. It helps in building and sustaining state power and establishing a social contract, fostering greater accountability between the state and its citizens. By requiring individuals and businesses to contribute a portion of their earnings, taxation ensures that resources are available for public goods and services, thereby enhancing social equity and cohesion.

Through tax reforms, governments can develop more responsive and accountable governance, expanding state capacity and enhancing legitimacy. Effective tax systems can lead to the development of policies that reflect the needs and preferences of the population, strengthening the bond between the government and its people. This accountability and responsiveness can create a virtuous cycle, where improved public services lead to greater trust in the government, encouraging compliance and further strengthening the state.

Thus, income tax is not only vital for revenue generation but also for creating effective, self-sustaining states capable of meeting their citizens’ needs and promoting overall societal welfare. The importance of income tax extends beyond mere financial considerations, contributing significantly to the building of a stable, equitable, and prosperous society.

Current Landscape

The landscape of personal income tax (PIT) in India has seen significant growth over recent years, reflecting the country’s expanding economy and improved tax compliance. In the financial year 2020-21, gross personal income tax, including the Securities Transaction Tax (STT), stood at ₹5.75 lakh crore. This marked a substantial contribution to the national revenue, even amidst the economic challenges posed by the COVID-19 pandemic.

In the following financial year 2021-22, there was a notable increase in gross PIT collections, which rose to ₹7.10 lakh crore. This growth can be attributed to the gradual economic recovery and enhanced tax collection mechanisms. The trend continued in 2022-23, with amount reaching ₹9.67 lakh crore, demonstrating the effectiveness of ongoing tax reforms and the buoyant economic environment.

By 2023-24, the personal income tax collections, including STT, had surged to an impressive ₹12.01 lakh crore (provisional, as of April 21, 2024)). This significant increase underscores the resilience and robustness of the Indian economy, along with improved taxpayer compliance and the government’s efforts to broaden the tax base. The upward trajectory of PIT collections highlights the crucial role of income tax in supporting India’s economic infrastructure and public welfare programs.

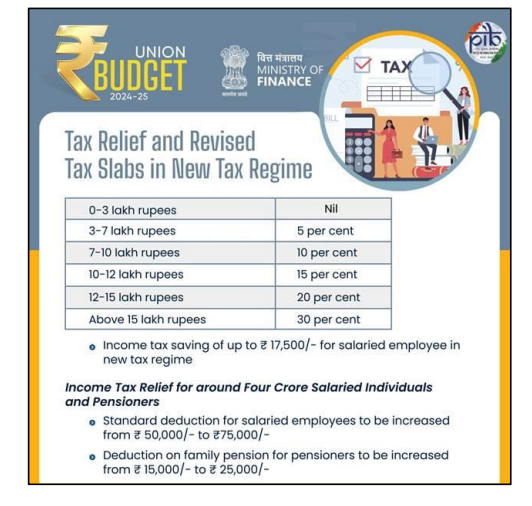

Budget 2024-25: Income Tax Slab Changes

The Budget for 2024-25 introduced several changes to the income tax regime to benefit salaried employees and pensioners. The standard deduction for salaried employees was increased from ₹50,000 to ₹75,000 for those opting for the new tax regime. Similarly, the deduction on family pension for pensioners was enhanced from ₹15,000 to ₹25,000. Additionally, assessments can now be reopened beyond three years, up to five years from the end of the year of assessment, only if the escaped income is more than ₹50 lakh. The revised tax regime provides significant benefits, with salaried employees potentially seeing benefits of up to ₹17,500 in income tax.

Other Notable Initiatives

The Central Government has undertaken several steps to boost tax collection and expand the tax base by curbing tax evasion, widening/deepening the tax base, promoting voluntary compliance through the use of technology, and promoting digital transactions. Some of the steps taken by the Government are as follows:

Simplification of the Personal Income Tax

- Finance Act, 2020: Provided an option to individual taxpayers for paying income tax at lower slab rates if they do not avail of specified exemptions and incentives.

- Finance Act, 2023: Increased the scope and reduced the rates applicable to individuals by providing that with effect from the assessment year 2024-25, the rates under section 115BAC(1A) of the Income-tax Act, 1961, shall be the default rates.

New Form 26AS

- Contains all information on the deduction or collection of tax at source, specified financial transactions (SFT), payment of taxes, demand and refund, etc.

- Details of SFT data in Form 26AS make taxpayers aware of their transactions beforehand, encouraging them to disclose their true income.

Pre-filling of Income Tax Returns (ITR)

To make tax compliance easier, pre-filled ITRs have been provided to individual taxpayers. The scope includes information such as salary income, bank interest, dividends, etc.

Updated Return

Section 139(8A) of the Act: Facilitates taxpayers to update their return anytime within two years from the end of the relevant assessment year, allowing them to file an updated return by voluntarily admitting omissions or mistakes and paying an additional tax as applicable.

E-Verification Scheme

This scheme enables authorities to collect information for the accurate and comprehensive determination of a taxpayer’s income to reduce tax evasion. It provides taxpayers with relevant financial information collected from various sources.

Setting Up of Dispute Resolution Committee (DRC)

For reducing litigation and giving an impetus to dispute resolution for small taxpayers, a DRC has been constituted. Taxpayers with taxable income up to ₹50 lakh and disputed income up to ₹10 lakh are eligible to approach the Committee. The procedure is conducted on a digital platform under the e-Dispute Resolution Committee Scheme, 2021.

Expansion of Scope of TDS/TCS

To bring new taxpayers into the income tax net, the scope of TDS/TCS was expanded to include huge cash withdrawals, foreign remittance, purchase of luxury cars, e-commerce participants, and the sale of goods.

Income Tax Returns

Income Tax Return (ITR) is a form that individuals are required to submit to the Income Tax Department of India. It contains information about the person’s income and the taxes to be paid on it during the year. Information filed in ITR should pertain to a particular financial year, starting on 1st April and ending on 31st March of the following year.

Number of persons who filed income tax returns in the last four years:

2019-20: 6.48 crore

2020-21: 6.72 crore

2021-22: 6.94 crore

2022-23: 7.40 crore

These figures reflect a consistent increase in the number of individuals filing their income tax returns, indicating an expanding tax base and improved tax compliance.

Conclusion

As India observes Income Tax Day 2024, it is evident that the nation’s tax administration has come a long way since its inception in 1860. The journey from a rudimentary tax system to a sophisticated, technology-driven framework is a testament to the country’s progress. This day also serves as a reminder of the historical evolution of tax administration in India and the ongoing reforms that aim to enhance tax compliance and simplify the process for taxpayers. The substantial increase in personal income tax collections, alongside the recent changes introduced in the 2024-25 Budget, reflects the government’s commitment to a fair and efficient tax system. By improving deductions, revising tax slabs, and expanding digital and procedural innovations, the government continues to strengthen its approach to taxation. Income Tax Day is not only a celebration of our fiscal heritage but also an opportunity to acknowledge the vital role that taxation plays in supporting public services and national development. As we look to the future, the progress made in tax administration and the proactive measures taken to address challenges will undoubtedly contribute to a more robust and equitable economic framework, fostering a prosperous and sustainable future for all.

Source: PIB