GConnect Income Tax Calculator for the Financial year 2015-16 launched

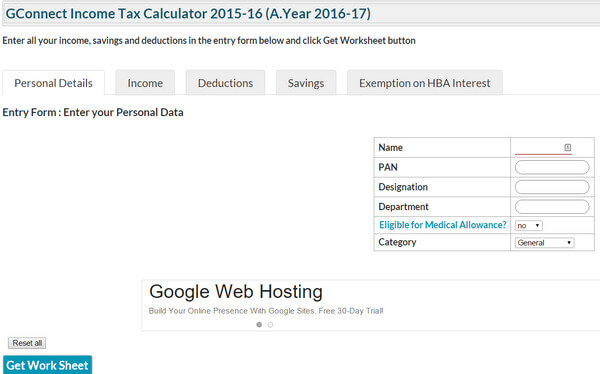

GConnect Income Tax Calculator for the Financial year 2015-16 (Assessment Year 2016-17) – Plan your Income Tax liability well in advance to avoid additional Income Tax deduction in excess of actual income tax payable.

As in previous years, GConnect has come up with an online tool for calculating Income Tax for the year 2015-16 (Assessment Year 2016-17).

As in previous years, GConnect has come up with an online tool for calculating Income Tax for the year 2015-16 (Assessment Year 2016-17).

New features of Income Tax Calculator 2015-16:

1. Of course, this Income Tax Calculator has been developed taking in to account all the changes in income tax provisions for the year 2015-16.

2. Keeping in view with usage of more mobile and Tablet devices this new tool is fully responsive.

3. Tabbed view of the tool accommodates more information

4. All description / type of income, deduction and savings mentioned in the tool are provided with tool tips which contain detailed information. Point the mouse on the description with question mark to read those information.

5. Important Income Tax Provisions have been tagged with each description / type of income, deductions, and savings by way of hyperlink against each in a document icon, which will open relevant income tax provisions. For Example, if you need to verify the latest income tax provisoins with respect to Section 80D concerned with deductions available on Health Insurance Premium, click the documentt icon against ‘Section 80D’ in Deductions Tab of Entry Form. This will open the Income Tax Provisions relating to Section 80D as a web page.

Click here to reach GConnect Income Tax Calculator 2015-16 (Assessment Year 2016-17)

How to use GConnect Income Tax Calculator 2015-16?

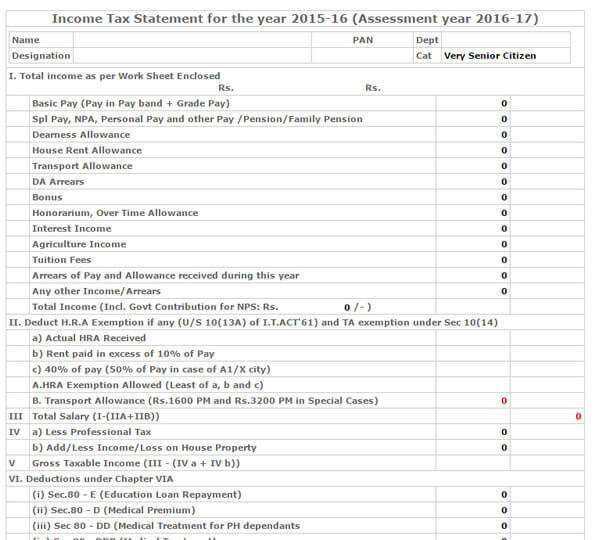

This online tool has three parts. 1. Entry Form, 2. Work Sheet and 3. Income Tax Statement which will be generated in a different web page.

1. Enter all your income, savings and deductions in the entry form and click get worksheet button.

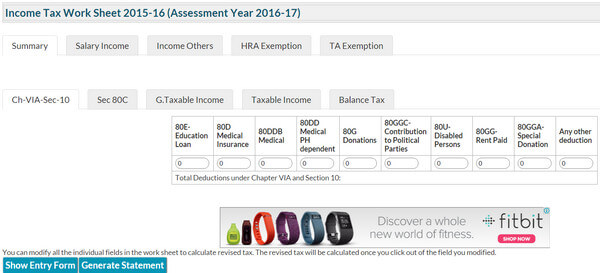

2. Now, Income Tax Work Sheet would be generated below Entry form (after “Get work sheet” button). This Work sheet contains the following tabs

1. Month wise salary income,

2. One time income such as bonus etc., (Income Others)

3. HRA Exemption and TA Exemption

4. Summary of Deductions allowed under Section 10 and Chapter VIA

5. Section 80C, CCC, CCD savings

6. Gross Taxable Income

7. Taxable Income

8. Balance Income Tax Payable.

Check the Income Tax Work Sheet by navigating to all these tabs. Once you have ensured that Income and Tax calculated are correct, click ‘Generate Statement’ Button to get Income Tax Statement along with Work Sheet (in 4 pages). Use “Print Statement” Button in the Statement page to get the same printed.

As far as Salary Income is concerned, this tool gets the monthly value of each type of income in the entry form. This value is used for preparing month wise salary income for the entire year in the Work Sheet.

In case, your pay in pay band, Grade Pay, TA, HRA etc changes in the middle of the month or year, due to promotion, MACP, transfer etc., Work Sheet can be edited manually for the respective period. In other words, you can modify all the individual fields in the work sheet to calculate revised tax. The revised tax will be calculated once you click out of the field you modified.

This is the instant version of the GConnect Income Tax Calculator tool. We would come up with Income Tax Calculator 2015-16 with save option soon. In the mean time use this tool to find out your Income Tax liability and plan for saving taxes in advance.

Why Tax planning is important?

Finance Minister announced during his budget speech that a salaried employee can deduct up to Rs. 4,69,200/- from his / her salary income.

| Deductions under 80C | Rs. 1,50,000 |

| Deductions under 80CCD for contribution to NPS | Rs. 50,000 |

| Interest on house property loan | Rs. 2,00,000 |

| Exemption with new transportation allowance of Rs. 1,600 per month | Rs. 19,200 |

| New deductible health insurance premium (self/family and for parents) | Rs. 50,000 |

| Total | Rs. 4,69,200 |

Consequently, a salaried employee can reduce his/her income tax liability up to Rs. 25,000 if his / her income is less than Rs. 5 lakh and up to Rs.68, 840 if his/her income exceeds Rs. 5 lakh.

However, Tax Saving to this extent would be possible only if the tax payer plans in advance by allocating amount for Savings under Section 80C, Health Insurance Premia etc. At the same time, deductions claimed by an employee has to be intimated to DDO in advance, to avoid additional Income Tax deduction in excess of actual income tax payable.

Further, it is the responsibility of all DDOs in Central Government Departments to deduct income tax on the taxable income of a government Employee and pay in govt account on quarterly basis. DDOs are also responsible to submit quarterly statement of TDS deducted from salary of the Employees. In order to determine Income Tax liability of employees, DDOs have to take in to account income from other sources declared by employee, deductions claimed by employees etc apart from Salary Income.

Hence, Central Government Employees including Railway Employees and Defence Personnel are expected to provide an Income Tax Statement to his/her Employer (DDO) containing the details of his/her Salary Income, income from other sources, deductions claimed under chapter VIA, exempt income under Section 10, Income Tax relief claimed on arrears of income etc on or before Ocotber / November every year.

Changes in Income Tax Structure and provisions for deductions and exemptions during the year 2015-16

There is no change in Income Tax Structure in the financial year 2015-16 (Assessment Year 2016-17). Following Changes have been made in the Budget 2015 in respect of admissible deductions from salary income, which would impact the income tax liability.

Tax benefits under section 80C for the girl child under the Sukanya Samriddhi Account Scheme:

Pursuant to the Budget announcement in July 2014, a special small savings instrument for the welfare of the girl child has been introduced under the Sukanya Samriddhi Account Rules, 2014.

The following tax benefits have been envisaged in the Sukanya Samriddhi Account scheme:-

(i) The investments made in the Scheme will be eligible for deduction under section 80C of the Act.

(ii) The interest accruing on deposits in such account will be exempt from income tax.

(iii) The withdrawal from the said scheme in accordance with the rules of the said scheme will be exempt from tax. With a view to allow the deduction under Section 80C to the parent or legal guardian of the girl child, amendment of Section 80C of the Act is proposed to be made so as to provide that a sum paid or deposited during the year in the Scheme in the name of any girl child of the individual or in the name of any girl child for whom such individual is the legal guardian, would be eligible for deduction under Section 80C of the Act. (The above amendments will take effect from 1st April, 2015.)

Increased deduction in respect of Health Insurance Premia under Section 80D:

After amendment made by Finance Act 2015, Section 80D now provides for deduction of amount paid towards health insurance as follows.

To keep in force an insurance on the health of the tax payer or his/ her family or any contribution made to the Central Government Health Scheme or any payment made on account of preventive health check-up of the tax payer or his/ her family which shall not exceed Rs. 25,000 (It was Rs. 15,000 last year)

To keep in force an insurance on the health of the parent or parents of the tax payer or any payment made on account of preventive health check-up of the parent or parents which shall not exceed Rs. 25,000/- (It was Rs. 15,000 in the previous year)

In the case of Parents who are Senior Citizens, amount that can be deducted in respect of Health Insurance Premia, has been increased to Rs. 30,000 (It was Rs.20,000 in the previous year)

Section 80DD: Deduction for medical treatment of physically challenged dependents:

In the case of salaried employee who is taking care of physically challanged Dependent Relative, an amount with the maximum limit of Rs.75000/- (it was Rs. 50,000 earlier) spent towards medical treatment or rehabilitation can be deducted from the income, In the case of severe disability maximum deduction would be Rs. 1,25,000 (It was Rs. 1,00,000 earlier

Section 80DDB: Deduction in respect of specified disease:

Deduction in respect of specified disease for self or dependent relatives is allowed lower of Rs.60,000 or actual amount paid. This deduction amount increases to Rs.80,000 in case of senior citizen.

Section 80U: Deduction in respect of Person suffering from Physical Disability

Deduction of Rs. 75,000/- in respect of tax payer suffering from a physical disability. In the case of severe disability, deduction of Rs. 125,000/- will be allowed. Certificate from the approved medical authorities regarding the extent of disability will have to be produced (Rule 11D)

Section 80CCC Deduction in respect of Premium Paid for Annuity Plan:

Deduction in respect of Premium Paid for Annuity Plan of LIC or Other Insurer. Payment of premium for annuity plan of LIC or any other insurer Deduction is available upto a maximum of Rs. 150,000/- (It as Rs. 1,00,000 earlier)

Additional deduction under Section 80CCD:

With a view to encourage people to contribute towards National Pension System (‘NPS’), it was proposed to remove the restriction under Section 80CCD(1A) of the Act, which currently restricts deduction under Section 80CCD(1) of the Act to Rs.1,00,000/-.

Therefore the limit for deduction under section 80CCD(1) of the Act, stands enhanced of Rs.1,50,000/-.

Section 80CCD (1):

Deduction in respect of Contribution to Pension Account (by Assessee). Deduction available for the amount paid or deposited in a pension scheme notified or as may be notified by the Central Government subject to a maximum of :

(a) 10% of salary in the previous year in the case of an employee

(b) 10% of gross total income in any other case.

Section 80CCD(1A):

The maximum deduction allowable under this section is Rs. 1.00 lakh. in case of contribution to New Pension Scheme (NPS), it is Rs. 1.50 lakh w.e.f. 01.04.2015

Additional Savings eligible for Tax Exemption up to Rs. 50,000/- under Section 80 CCD (1B)

Section 80CCD(1B):

Contribution in NPS has been given more tax concession in the budget 2015. As per Section 80CCD(1B), an additional deduction of up to Rs. 50,000 over and above the Section 80C, 80CCC and 80CCD savings cap of Rs. 1.5 lakh, is allowed if such amount is contributed by the employee. So, overall tax savings of Rs. 2 lakh can be availed under Section 80C, 80CCC and 80CCD(1).

Check the following links for more details of on Changes in Income Tax Provisons in the year 2015-16

Provisions relating to Direct Taxes in Finance Bill 2015

Income Tax 2015-16 – Deductions and Exemptions for Salaried Employees