How to use new GConnect Income Tax Calculator 2014-15 ?

GConnect launches new online Income Tax Calculator for the Financial Year 2014-15 (Assessment Year 2015-16) – It is fully Responsive (capable of viewing in array of devices such as Mobile, Tablet, PCs etc with different Screen sizes)

GConnect always endeavors to provide up to date personal Income Tax information and easy to use Income Tax Calculators from time to time. Especially, GConnect online Income Tax Calculators which are launched every year right from 2009, have received huge response from Central Government Employees and pensioners, as it has helped them to easily calculate their Income tax liability well in advance and plan for savings / deductions / investments on monthly basis.

How GConnect Income Tax Calculator 2014-15 Functions ?

1. It collects monthly and annual values of pay, allowances, pension, deductions etc in the interface called Entry Form and populates the same after necessary calculations in the Income Tax work sheet.

The elements calculated by this tool are as follows:

(a). Total Salary Income,

(b). Income Tax Exemption for HRA,

(c). Interest on housing loan (Income or Loss on House Property)

(d). Income Tax Exemption on Transport Allowance,

(e). Total and eligible deductions under Chapter VIA and Section 10

(f). Total and eligible deductions under Section 80C, 80CCC, 80CCD(1), 80CCD(2)

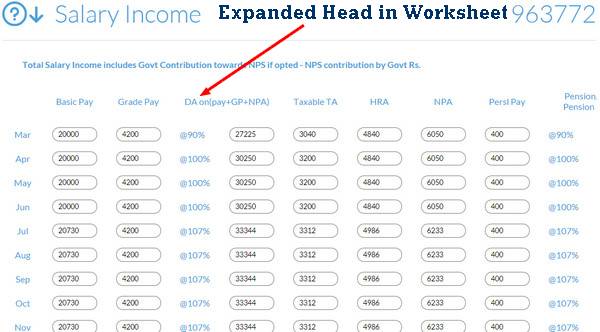

(g). Total and Net Income Tax Payable

2. Income Tax Work Sheet contains monthly values of pay and all allowances as well as annual values of all income and deductions. It also shows Taxable Income and Income Tax to be paid. Work Sheet can be edited for modification in pay, allowances or pension for individual months.

There is no need for editing the work sheet for those whose pay, allowances or pension do not change (except for annual increment and change in DA) in the middle of the year. If pay, allowances or pension change in the middle of the year due to promotion, MACP, transfer or any other revision, the monthly values can always be changed individually in the work sheet.

Also the amount of deductions or exemptions calculated automatically such as HRA Exemption, Income or Loss on House property (IT Exemption on housing loan interest), IT rebate for Government contribution in NPS etc can be edited if necessary.

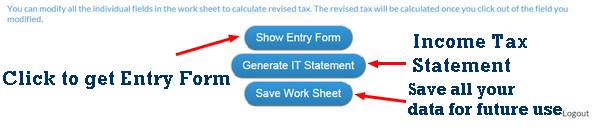

3. Once it is found that the income, deductions and income tax in the work sheet are correct, we can generate Income Tax Statement for the Year 2014-15 with working sheets which are to be submitted to DDO / Employer.

How to use GConnect Income Tax Calculator 2014-15 ?

1. Go to GConnect Income Tax Calculator Login Page – incometax.gconnect.in – Click here to reach GConnect Income Tax Calculator login page

2. Enter User Name and Password and Click Login button. If you had already used GConnect Income Tax Calculators in the previous years, same user name and password can be used now. If you forgot user name or password, provide the email id you used while registration and get the user name and password in your email inbox. If you are new to this tool, you can register and get the user name and password instantaneously

Click here to reach GConnect Income Tax Calculator login page

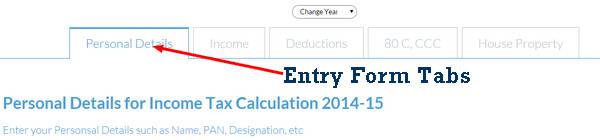

3. For ease of use, Income Tax Calculator’s Entry Form is now made up of Tabs. Each head of entry form is put into a single tab, for making data entry work easier.

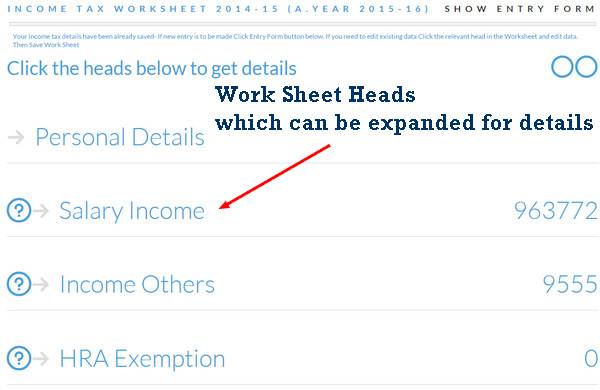

4. After you have entered the values in the entry form, click Generate Work Sheet Button. If any of the fields in the Entry form are not relevant to you, leave it as such. Now Income Tax Work Sheet will be displayed with various heads such as Total Income, Deductions under Chapter VIA, Balance Income Tax Payable etc with values against the same. Click on these heads to get the detailed calculations.

5. The expanded form of Work Sheet can be edited by user if necessary as explained above (Para 2 of topic “How GConnect Income Tax Calculator 2014-15 Functions ?”)

6. After editing Work Sheet if necessary Click Save Work Sheet button to save all the values for future use. This feature is very much needed as there are too many values involved in calculation of Income Tax and it will be difficult to remember and re-enter values. The saved income tax work sheet can be viewed or edited at any time once you logged on to GConnect Income Tax Calculator. Also Income Tax Statement for the Year 2014-15 can be generated and printed out as pdf file.

7. Logout from the tool by clicking Logout Link

8. For details of income tax provisions, method etc for individual values, move the mouse pointer over the Question Mark symbol found against each head.

9. While you are using this online tool for this year, you can also inspect the income tax statements for previous year by selecting values in the year dropdown.

Important Changes in Income Tax Calculation for 2014-15 (Assessment Year 2015-16)

As far as Income Tax Calculation for the year 2014-15 (Assessment Year 2015-16) following three Important Changes have been made which mainly benefit Salaried Employees.

1. Income Level for full income Tax Exemption increased from Rs. 2 lakh to Rs. 2.5 lakh

2. Amendment in Section 80CCE of Income Tax provides for deductions under Section 80C, 80CCC and 80CCD up to Rs.1.5 lakh. Earlier total deduction can not exceed Rs. 1 lakh. While all deductions limited by Section 80CCE has individual limit of Rs. 1.5 lakh, deduction in respect of Contribution to NPS by Employees is limited to Rs. 1 lakh.

3. Income Tax Rebate / Exemption on Interest Payable on Housing Loan under Section 22 has been increased from Rs. 1.5 lakh to Rs. 2 lakh.