Electronic Verification Code for Income Tax Online – Additional Modes announced

Electronic Verification CODE (EVC) for Income Tax Returns filed online – CBDT has come up with more additional modes for EVC to facilitate Tax payers

CBDT announced Additional modes of generating Electronic Verification Code (EVC) in addition to EVC notified vide earlier Notification No.2/2015 dated 13/07/2015. The two additional modes are i) By pre-validating Bank account details and ii) By pre-validating Demat account details.

F No.1/23/CIT(OSD)/E-filing- Electronic Verification /2015-16

Government of India

Ministry of Finance

Central Board of Direct Taxes

Directorate of Income Tax (Systems)

Notification No.1 /2016

New Delhi

Dated the 19th day of January 2016

Subject: Electronic Verification CODE (EVC) for electronically filed Income Tax Return Additional Modes.

Explanation to sub rule (3) of rule 12 of the Income tax Rules 1962, states that for the purposes of this sub-rule “electronic verification code” means a code generated for the purpose of electronic verification of the person furnishing the return of income as per the data structure and standards specified by Principal Director General of Income-tax (Systems) or Director General of Income-tax (Systems). Further, Sub-rule (4) of Rule 12 of the Income Tax Rules 1962 states that the Principal Director General of Income-tax (Systems) or Director-General of Income-tax (Systems) shall specify the procedures, formats and standards for ensuring secure capture and transmission of data and shall also be responsible for evolving and implementing appropriate security, archival and retrieval policies in relation to furnishing the returns in the manners (other than the paper form) specified in column (iv) of the Table in sub-rule (3) and the report of audit or notice in the manner specified in proviso to sub-rule (2).

2 In exercise of the powers delegated by the Central Board of Direct Taxes (‘Board’) under Explanation to sub rule 3 and sub-rule 4 of Rule 12 of the Income tax Rules 1962, the Principal Director General of Income-tax (Systems) lays down the procedures, data structure and standards for additional modes of generation of Electronic Verification Code in addition to EVC prescribed vide earlier Notification No. 2/2015 dated 13th July 2015 as under:

Additional Modes of Generation of EVC:

Case (5): Where the EVC (Electronic Verification Code) is generated by giving bank details to the e-filing website https:l/incometaxindiaefiling.gov.in

A facility to pre-validate Bank account details will be provided to the assessee under Profile Settings menu in e-Filing website i.e.https://incometaxindiaefiling.gov.in. Assessee has to provide the following bank account details: 1. Bank account number 2. IFSC 3. Email ID and 4. Mobile Number. These details provided by the assessee along with PAN and Name as per e-filing database will be validated against the details of taxpayer registered with bank. If the pre-validation is successfully completed, assessee can opt for “Generate EVC using bank account details” option while verifying the Income tax return.

Generated EVC will be sent by e-filing portal to taxpayer’s Email ID and/or Mobile Number verified from bank.

List of Banks participating in this facility will be as provided in https://incometaxindiaefiling.gov.in

Case (6): Where the EVC (Electronic Verification Code) is generated after Demat account authentication using Demat details registered with CDSL/ NSDL

A facility to pre-validate Demat account details will be provided to the assessee under Profile Settings menu in e-Filing website i.e.https://incometaxindiaefiling.gov.in. Assessee has to provide the following Demat account details: 1. Demat account number 2. Email ID and 3. Mobile Number. These details provided by the assessee along with PAN and Name as per e-filing database will be validated against the details of taxpayer registered with depository (CDSL/NSDL). If the pre-validation is successfully completed, assessee can opt for “Generate EVC using Demat account details” option while verifying the Income tax return.

Generated EVC will be sent by e-filing portal to Email ID and/or Mobile Number verified from CDSL/NSDL.

The Depositories (CDSL/NSDL) participating in this facility will be as provided in https://incometaxindiaefiling.gov.in.

3. Other Conditions

The additional mode of EVC generation will come into effect from the date of issue of this notification. All other condition shall remain same as specified in Notification No 2/2015 dated 13.07.2015 issued by Pr. DGIT (Systems), New Delhi.

4. The mode and process for generation and validation of EVC and its use can be modified, deleted or added by the Principal DGIT (System)/ DGIT (System).

(Nishi Singh)

Pr. DGIT (Systems), CBDT

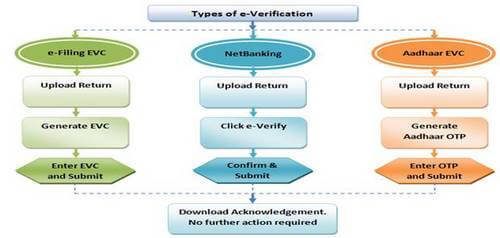

Electronic Verification for ITR using Aadhaar, Net banking or bank ATM

How to e-file ITR ? Step by Step guide to file Income Tax Return online