Budget 2025-26: Major Income Tax Relief Announced – Higher Exemptions, New Slabs

In the Union Budget for 2025-26, presented on February 1, 2025, Finance Minister Nirmala Sitharaman introduced significant reforms to the personal income tax structure, aiming to enhance the disposable income of the middle class and stimulate economic growth.

Key Changes in Income Tax:

- Increased Tax Exemption Threshold:

- The nil tax slab threshold has been raised to ₹12 Lakhs per annum, up from the previous ₹700,000. This adjustment allows individuals earning up to ₹12 Lakhs annually to be exempt from paying income tax.

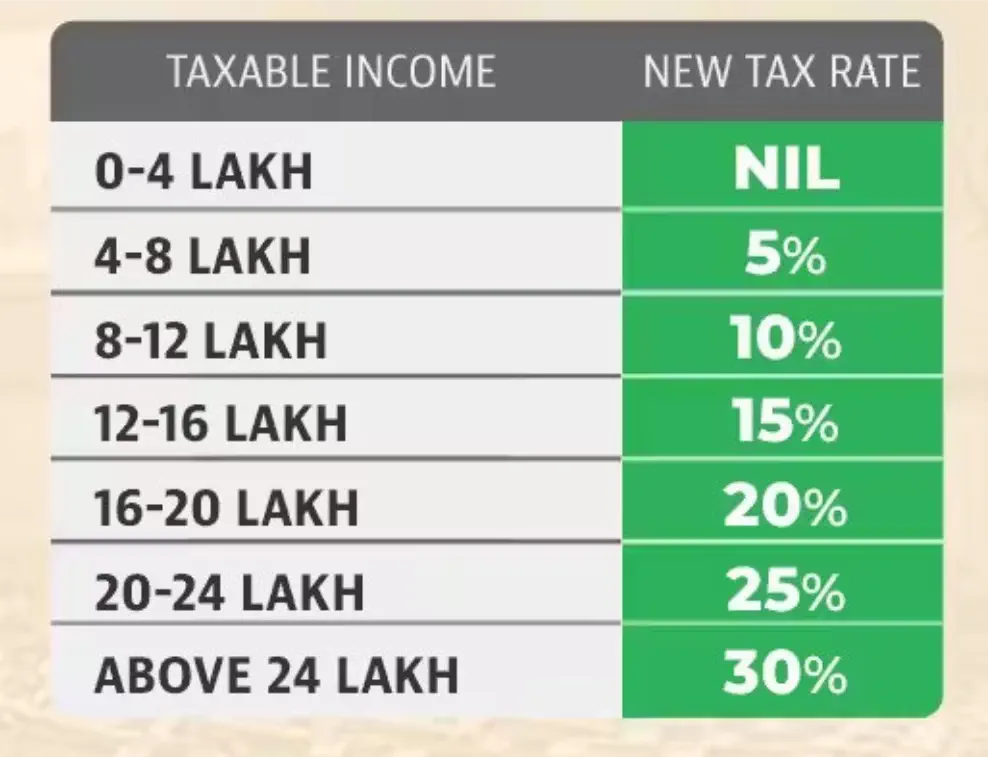

- Revised Tax Slabs and Rates:

- The income tax slabs have been restructured to benefit taxpayers across various income brackets.

- Under the new tax regime, the maximum tax rate of 30% now applies to incomes of ₹24 Lakhs and above.

- Enhanced Tax Rebate under Section 87A:

- The tax rebate under Section 87A has been increased to ₹60,000 from the previous ₹25,000. This change effectively raises the maximum total taxable income for which an individual taxpayer has no tax burden to ₹12 Lakhs under the new tax regime.

- Rationalization of TDS/TCS:

- The budget proposes to double the limit for tax deduction on interest earned by senior citizens from ₹50,000 to ₹100,000.

- The TDS threshold on rent has been increased from ₹240,000 to ₹600,000 per annum.

- The threshold for collecting TCS has been raised to ₹1 million.

Implications:

These measures are designed to increase the spending power of the middle class, thereby boosting consumer demand and contributing to economic growth. Analysts anticipate that the tax cuts will lead to higher consumption and savings among taxpayers.

The restructuring of tax slabs and the increase in the exemption threshold are expected to simplify the tax system and reduce the tax burden on individuals, aligning with the government’s objective of promoting inclusive development.