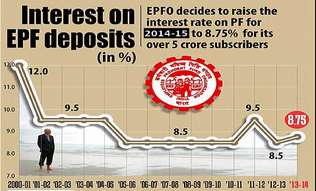

Employees Provident Fund interest retained at 8.75%

Employees Provident Fund interest retained at 8.75% – EDLI – Insurance under Employees Deposit Linked Insurance Scheme increased to Rs. 3.6 lakhs

The Employee Provident Fund Organisation retained the interest payment on provident fund deposits for 2014-15 at 8.75%, same as the previous year, but decided against investing in equities. These decision were taken at the first meeting of the Central Board of Trustees, the apex decision making body of EPFO, after the Narendra Modi government took over three months’ back.

“Employees will get interest at the rate of 8.75% in 2014-15,” labour minister Narendra Singh Tomar, who is also the chairman of EPFO, told media after the meeting. The EPFO has about 5 crore subscribers and the decision will have a bearing on their retirement fund. The decision to retain the interest rate on the provident fund deposits at last year’s level was taken despite some protest by the trade union members of the CBT, sources said. The interest rates for the current fiscal will be notified shortly after the finance ministry endorses it.

“The proposed pattern of investment by Ministry of Finance was discussed and deliberated by the Board and the Board was not in favour of investing in equities and Exchange Traded Funds (ETFs),” the EPFO said in a statement.

“It was decided to recommend the make the pattern more flexible to further increase the percentage of investment in government securities,” it said.

The finance ministry has been urging EPFO to invest in equities to enhance returns to subscribers and also open another avenue for funds for capital market.

Retaining the interest rates at last year’s level will leave EPFO with a surplus of Rs 242.6 crore at the current wage ceiling of Rs 6,500 per month. But the real implication will only be seen towards the last quarter of the financial year as the government has decided to raise the minimum wage ceiling to Rs 15,000 per month. EPFO has a corpus of around Rs 5 lakh crore.

Besides, CBT has decided to enhance the investment in government securities from 55% to up to 100% and said it will set up a PSU cell that will take decisions on the investments in public sector undertakings.

“We will create a PSU cell that will deliberate and decide on matters related to investments made by EPFO in public sector undertakings,” Tomar said.

It could invest in AAA rated central and state public sector companies.

Besides, the trustee have given its go ahead to EPFO to borrow short-term loans for more proactive management of its investments and have retained Crisil as consultant for the third time to engage new fund managers and evaluate their performance for three-year term beginning April 1, 2015.

The central board of trustees has also decided to set up a committee that will rope in more and more construction and contract workers under the ambit of the EPFO. The other members of CBT include minister of state for labour, labour secretary, representatives of trade unions and employers’ representatives.

Source : Economic Times