Providing Form 16 to all pensioners and family pensioners: CPAO

Providing Form 16 to all pensioners and family pensioners: CPAO OM dated 19.07.2022

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

DEPARTMENT OF EXPENDITURE

CENTRAL PENSION ACCOUNTING OFFICE

TRIKOOT-II, BHIKAJI CAMA PLACE,

NEW DELHI-110066

CPAO/IT&Tech/BankPerformance/37Vol-III(A)/101636/2022-23/124

19.07.2022

OFFICE MEMORANDUM

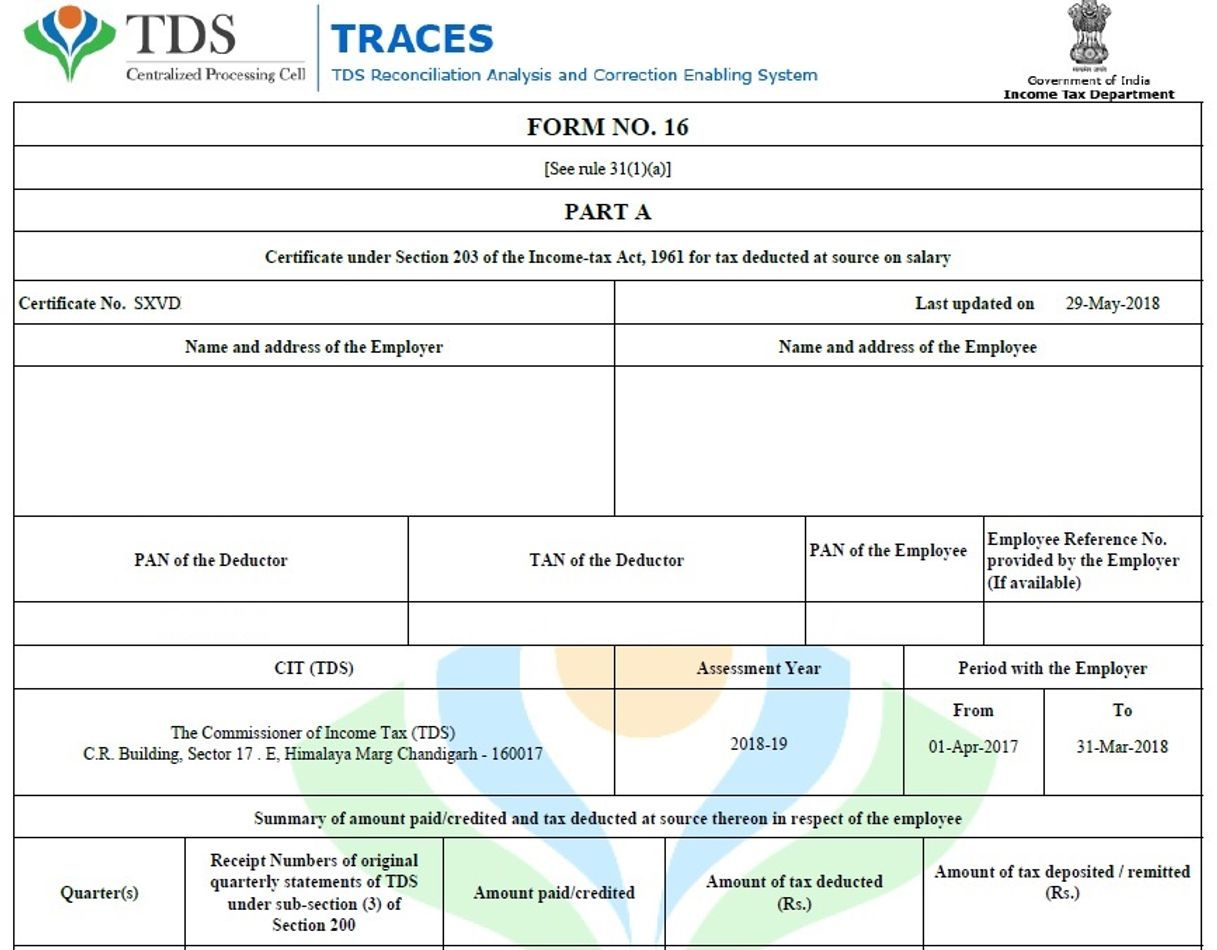

Subject: Providing Form 16 to all pensioners and family pensioners

The undersigned is directed to say that grievances are being received from Pensioners/ Family Pensioners about the non-issuance of Form 16 by the paying branches of the Agency Banks.

2. In this connection it is informed that Para 11.1 (vii) of the Scheme Booklet places the responsibility for issuance of Form 16 on the paying branch. The relevant paragraph is reproduced below for reference:

As the drawing and disbursing agency, the CPPC will be responsible for the deduction of TDS and its report to CPAO through scrolls and other reports as required by CBDT from time to time. While deducting such tax from pension payment, the paying branch will also allow deduction on account of reliefs available under Income Tax Act from time to time on production of proper and acceptable evidence of eligible savings by pensioners. The paying branch will issue to the pensioner in April each year a certificate of tax deducted in the form prescribed in the Income Tax Rules. The paying branch will also issue Certificate of Income from pension to the pensioner in the form as above with necessary modification, even in cases where no income tax is deducted at source, if the pensioner applies for such a certificate in writing.

3. All the Authorised Banks are hereby directed to comply with the provisions of the Scheme Booklet and issue Form 16 to all pensioners and family pensioners to enable them to file their Income tax Returns.

4. This issues with the approval of Chief Controller (Pensions). –

(Anang Rawat)

(Dy. Controller of Accounts)

Source: CPAO