Grant-in-Aid to Pensioners Associations with the Implementation of ‘Pensioners Portal’ Project

‘Pensioners Portal’ Project – Release of Grant-in-Aid to Pensioners Associations for implementation of the objectives of the Portal

F.No.55/16/2018-P&PW(C)(1)

Government of India

Ministry of Personnel, PG. and Pensions

Department of Pension & Pensioners’ Welfare

3rd Floor, Lok Nayak Bhavan,

Khan Market, New Delhi- 1100 03

Dated: 10th October, 2018

To

The Pay & Accounts Officer,

Department of Pension & Pensioners’ Welfare,

Lok Nayak Bhavan, Khan Market, New Delhi.

Subject: Web-based ‘Pensioners’ Portal’ Project – Release of Grant-in-Aid to Pensioners’ Associations for implementation of the objectives of the Portal.

Sir,

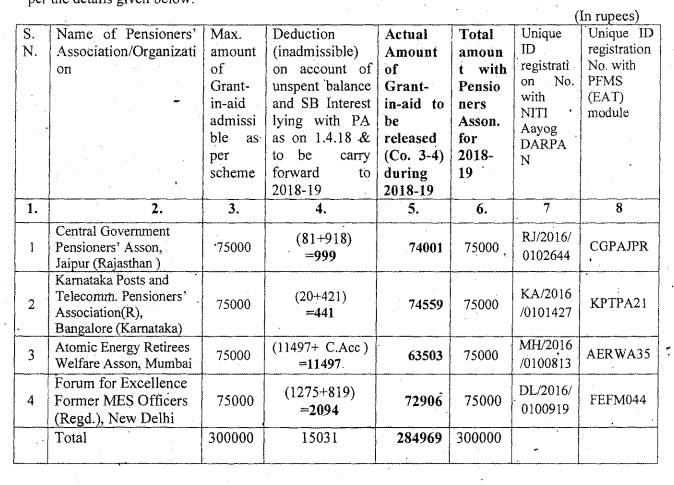

I am directed to convey the sanction of the President of India to the release of a sum of Rs.284969/- (Rupees Two Lakhs Eighty Four Thousand Nine Hundred and Sixty-Nine only) towards Grant-in-Aid in favour of the following 4 Pensioners Associations on their having been registered under NITI Aayog DARPAN and having been linked with PA&O under PFMS for meeting expenditure in connection with the implementation of objectives of ‘Pensioners’ Portal’, as per the details given below:

2. Utilisation Certificate in respect of earlier grant sanctioned to above Pensioner Association are enclosed.

3. Details of Recurring Grant for admissible Activities:

| (i) | Telephone + Internet Connection | Up to Rs. 12,000 per annum |

| (ii) | Stationery+ Battery replacement | Up to Rs. 19,500 per annum |

| (iii) | Subsidy towards Rent of Building/ Water/electricity/AMC of equipment | Up to Rs. 28,500 per annum |

| (iv) | Remuneration Payable to Data entry (Part time) per annum | Up to Rs. 15,000 per Operator |

| Total | Up to Rs. 75,000 per annum |

The maximum permissible amounts on {he individual component eligible for sanction/ reimbursement in the form of Grant-in-Aid are as follows with flexibility of 25% on higher/ lower side of individual component:

4. Any other expenditure by the Pensioners’ Association on any activity/component other than those mentioned above will not be admissible from the Grant-in-Aid and will be treated as an unspent amount, to be recoverable or adjusted from the future grant as the case may. In case the actual expenditure during the year on individual. component is less than the permissible amount on individual components, the difference of Grant-in-Aid and the actual expenditure will be treated as unspent and will be adjusted in the next year’s grant.

5. Further, the above Grant-in-Aid is subject to maintaining a separate Bank Account for the Grant-in-aid under Pensioners’ Portal. The Grantee shall also furnish a Utilization Certificate (in the prescribed proforma) for the grant received and utilized during the year 2018-19 within six months of the close of the financial year 2018-2019 i.e. upto 30th September, 2019. Failure to do so will make the Grantee Pensioner Association liable for refund of entire Grant-in-Aid amount along with the interest.

6. The Pensioners’ Associations are required to submit a consolidated performance-cum-Achievement report immediately after utilization of this grant. The Associations are also required to prepare their Annual work Plan for the current and next financial year before they could become eligible for Grant of any further Grant-in-Aid for the next financial year.

7. The grant is further subject to the terms and conditions as indicated in the Annexure.

8. The above Pensioners Associations is, therefore, advised to book the utilization of funds for approved components under the Scheme of GIA through EAT Module under PFMS. Any expenditure incurred otherwise than through EAT module will not qualify for adjustment against the Grant-in-aid being sanctioned and released and the Association will be liable to refund such amount to this Department:

9. In case of any difficulty in -booking Expenditure under PFMS, Pensioner Association may also contact PFMS Central Help Desk Contact number and email ID for PFMS-EAT Module query: PFMS Main e-mail ID: [email protected] and [email protected] and [email protected], The following are the Individual contact number and e-mail ID for PFMS-EAT MODULE query

i) Shri OM Pathak, PFMS Trainer Mobile No.08287789975 and Tele No. 011/24641225

ii) Shri Rajesh Jain, Sr.AO, Tele No. 011-24626331 and E-mail ID prao–[email protected]

iii) Shri Sat Narain, Sr. AO PH: 011-23343860 (Extn.270)- E-mail :[email protected]

iv) Shri T.M, Rajan, Sr.AO PH: 011-23343860 (Extn.279)- E-mail :cpsms.tmr@com

v) Vishnu Singh, Sr.AO -PH: 011-23343860 (Extn.280) -E-mail :[email protected]

vi) Shri S.Francis, Sr. AO -PH: 011-23343860 (Extn.284) – E-mail :cpsrns.f@com

vii) Shri K. Sridharan, Sr.AO -PH: 011-23343860 (Extn.281) E-mail :cpsms.ksri@com

10. While making any query on PFMS EAT MODULE through e-mail), please mention the following details (mandatory requirement):

CONTROLLER CODE: 034,

GRANT NO. : 70

SCHEME NAME : 0720 (ADMINISTRATIVE REFORMS & PENSIONERS SCHEME)

NAME OF THE PENSIONER ASSOCIATION –

AGENCY UNIQUE CODE

In View of the above Pensioner Associations are advised to book the expenditure against grant-in-aid only through PFMS EAT Module for the prescribed components as mentioned in the Sanction letter.

11. The Drawing & Disbursing Officer of the Department of Pension & Pensioners’ Welfare is authorized to draw the amount as mentioned in Col 5 of Table given in para 11 above for disbursement to the Grantee Pensioners Association by way of transferring the amount to the Bank Accounts of respective Pensioners’ Associations.

12.The expenditure involved is debitable to Major Head “2070”- Other Administrative Services 00.800. Other Expenditure, ( Minor Head); 43- Plan Scheme of Department of Pensions and Pensioner Welfare, 43.01 Pensioners Portal; 43.01.31 – Grants-in-Aid-General under Demand No.- 70 Ministry of Personnel, Public Grievances & Pensions for the year 2018 19.

13. The accounts of the above Pensioners Associations shall be Open to inspection by the sanctioning authority-and the audit, both by the Comptroller and Auditor -General of the India under the provision of CAG (DPC) Act, 1971 and internal audit by the Principal Accounts Officer of the Department of Pension & Pensioners’ Welfare, whenever the organization is called upon to do so.

14. This sanction issues under financial powers delegated to the Ministries/Departments of the Government of India with the concurrence of Integrated Finance Division vide Diary No. Dir (F/P)/E5250 dated 27.09.2018.

15. The expenditure of Rs. 284969/- (Rupees Two Lakhs Eighty Four Thousand Nine Hundred and Sixty-Nine only) has been noted in the grant-in-air register for the year 2018-2019.

Yours faithfully,

(Manoj Kumar)

Under Secretary to the Govt. of India