NPS for NRIs – Frequently Asked Questions

NPS for NRIs – Frequently Asked Questions compiled by PFRDA – Non-Resident Indians can open NPS after following KYC norms

FREQUENTLY ASKED QUESTIONS

NATIONAL PENSION SYSTEM for NON RESIDENT INDIANS

About NPS

1. What is National Pension System?

NPS is an easily accessible, low cost, tax-efficient, flexible and portable retirement savings account. Under the NPS, the individual contributes to his retirement account. NPS is designed on Defined contribution basis wherein the subscriber contributes to his own account. The benefit subscribers ultimately receive depends on the amount of contributions, the returns made on the contributions and the period of contributions.

Contributions + (Individual contributions)

Investment Growth – Charges = Accumulated Pension Wealth

2. What is the NPS Architecture?

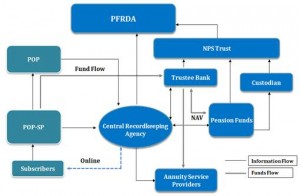

PFRDA has put in place an unbundled architecture managed through a set of Intermediaries who have experience in their own areas of operations. Each intermediary, looking after specific activities such as record keeping, fund transfers, fund management and custodial services etc., has been selected through competitive bidding process to bring about the advantages of low-cost and effective checks & balances in the system to the subscriber.

· Central Record keeping Agency- Appointed by PFRDA and entrusted with the record keeping of the data of individual subscribers; also acts as an interface between the different intermediaries in the NPS system.

· Points of Presence (PoP) and POP-Service Provider (PoP-SP)- Appointed by PFRDA, they include mainly commercial banks who act as the first points of interaction of the NPS subscriber under the NPS architecture. The authorized branches of a POP, called Point of Presence Service Providers (POP-SPs), act as collection points and extend a range of customer services to NPS subscribers.

· NPS Trust & Trustee Bank- The NPS Trust (established by the PFRDA) is responsible for taking care of the funds under the NPS. The Trust holds an account with a bank and this bank is designated as ‘Trustee Bank’. The Trustee Bank remits funds to the entities viz. Pension Funds (PFs), Annuity Service Providers (ASPs) and subscribers on receipt of instructions from CRA.

· Pension Funds- Appointed to invest the Pension Fund contribution of all the subscribers in various schemes.

· Annuity Service Providers- Are life insurance companies regulated by IRDA and empanelled with PFRDA for investing subscriber retirement savings in Annuity scheme and delivering monthly pension to the subscriber.

· Custodian- Stock Holding Corporation of India Limited has been appointed as a Custodian for providing custodial services to the NPS.

3. What are the features of the retirement account provided under NPS?

The following are the most prominent features of the retirement account under NPS:

· Every individual subscriber is issued a Permanent Retirement Account Number (PRAN)

card which has a 12 digit unique number.

· Under NPS account, two sub-accounts – Tier I & II are provided. Tier I account is mandatory and the subscriber has option to opt for Tier II account opening and operation. The following are the salient features of these sub-accounts:

Ø Tier-I account: This is a permanent retirement account where under withdrawals up to 25% of the subscribers’ own contribution are permitted as per the Withdrawal and Exit Regulations (discussed in detail under Exit & Withdrawal section of this FAQ).

Ø Tier-II account: This is a voluntary savings facility available as an add-on to any Tier-1 account holder. Subscribers will be free to withdraw their savings from this account whenever they wish.

4. In what way is the NPS Portable?

The following are the portability features associated with NPS

· NPS account can be operated from anywhere in the country irrespective of individual employment and location/geography.

· Subscribers can shift from one sector to another like Private to Government or vice versa or Private to Corporate and vice versa. Hence a private citizen can move to Central Government, State Government etc with the same Account. Also subscriber can shift within sector like from one POP (Point of Presence) to another POP and from one POP-SP (Point of Presence Service Provider) to another POP-SP. Likewise, an employee who leaves the employment to become a self-employed, can continue with his individual contributions. If he enters re-employment he may continue to contribute and his employer may also contribute and so on.

– The subscriber can contribute to NPS from any of the POP/ despite not being registered with them and from anywhere in India.

5. Can I have more than one NPS account?

No, multiple NPS accounts for a single individual are not allowed and there is no necessity also as the NPS is fully portable across sectors and locations.

Eligibility

6. Can an NRI join NPS?

Yes, an NRI between the age of 18 – 60 years, as on the date of submission of his/her application and complying with the extant KYC norms, can open an NPS account.

7. Can an NRI open a joint account in NPS?

No, only an individual account can be opened in NPS.

8. Is account operation with Power of Attorney (POA) allowed under NPS for NRIs?

At present, POA facility is not available in NPS.

NPS Account Opening

9. How and where can I open a NPS account?

NPS is distributed through authorized entities called Points of Presence (POP). Almost all the banks (both private and public sector) in India are enrolled to act as Point of Presence under NPS. To invest in NPS, you are required to open an NPS account through a POP bank, preferably where you have your NRI account. You can send your NPS application form to your Bank for opening of the NPS account.

10. How will I know about the status of my PRAN (Permanent Retirement Account Number)

application form?

Subscriber can check the status by accessing NSDL e-Governance Infrastructure Ltd., the CRA website: https://cra-nsdl.com/CRA/ by using the 17 digit receipt number provided by POP-SP or the acknowledgement number allotted by CRA-FC (Facilitation Centre) at the time of submission of application forms by POP-SP. Once the PRAN is generated, an email alert as well as a SMS alert will be sent to the registered email ID and mobile number of the subscriber.

11.What are the documents that need to be submitted for opening a NPS account?

The following documents need to be submitted to your Bank (POP) for opening of a NPS account:

a. Completely filled in subscriber registration form

b. Copy of Passport

c. Proof of Address, if the local address is different from the address in your passport.

12. Can I appoint nominees for the NPS Tier I and Tier II Account?

Yes, you need to appoint a nominee at the time of opening of a NPS account in the prescribed section of the registration form. You can appoint up to three nominees in your NPS Tier I and NPS Tier II account. In such a case you are required to specify the percentage of share, which should not be in decimals that you wish to allocate to each nominee. The share percentage across all nominees should collectively aggregate to 100%.

13. I have not made any nomination at the time of registration. Can I nominate subsequently? What is the process?

If you have not made the nomination to your NPS account at the time of registration, you can do the same after the allotment of PRAN. You will have to visit your PoP and place Service Request to update nominations details.

14.Are there any charges for making a nomination?

If you are making the nomination at the time of registering for PRAN, no charges will be levied to you. However, a subsequent request for nomination updation would be considered as a service request and you will be charged an amount of Rs. 20/- plus applicable service tax for each request.

15.Can I change the Nominees for my NPS Accounts?

Yes, you can change the nominees in your NPS Tier I account at any time after you have received your PRAN.

NPS– Charges

16.What are charges applicable in NPS?

| Intermediary | Charge Head | Service Charge | Method of

Deduction |

|

POP |

Initial Subscriber Registration |

Rs. 125 |

To be Collected Upfront |

| Initial Contribution | 0.25% Min: Rs. 20 & Max : Rs.25,000 | ||

| All Subsequent Contribution | |||

| All Non-Financial Transaction |

Rs. 20 |

||

|

CRA |

PRA Opening (One Time) |

Rs. 50 |

Through NAV cancellation/deduction |

| PRA Maintenance (Per Annum) |

Rs. 190 |

||

| Per Transaction (Financial/Non- Financial) |

Rs. 4 |

||

| Custodian | Asset Serving (Per Annum) |

0.0075% |

|

| PFM | Investment Management (Per

Annum) |

0.01% |

NPS– Contributions, Investments and Asset Classes

17.Are there any minimum annual contribution requirements under NPS? How can I

reactivate / unfreeze the account if frozen due to minimum contribution requirements?

Yes, a subscriber has to contribute a minimum annual contribution of Rs.6000/- for his Tier I account in a financial year and if not contributed the account will be frozen. In the first year, the account will remain active, but from 2nd year onwards if minimum contribution is not made, account will be frozen. In order to unfreeze the account, the customer has to pay the total of minimum contributions for the period of freeze, the minimum contribution for the year in which the account is reactivated and a penalty of Rs.100/-. In order to unfreeze an account the subscriber has to approach the Point of Presence (POP) and deposit the required amounts. The following table provides the complete information on the minimum contribution requirements:

| For All citizens model |

Tier I |

Tier II |

| Minimum Contribution at the time of account opening | Rs. 500 | Rs. 1000 |

| Minimum amount per contribution | Rs. 500 | Rs. 250 |

| Minimum total contribution in the year | Rs. 6000 | Rs. 2000 |

| Minimum frequency of contributions | 1 per year | 1 per year |

18.How are the funds contributed by the subscribers managed under NPS?

The funds contributed by the Subscribers are invested by the PFRDA registered Pension Fund Managers (PFMs) as per the investment guidelines prescribed by PFRDA. The investment guidelines are framed in such a manner that the portfolio is adequately diversified across financial securities so that there is minimal impact on the returns on subscribers contributions even if there is a market downturn, by ensuring a judicious mix of investment instruments like Government securities, corporate bonds and equities. At present there are eight Pension Fund Managers who manage the funds at the option of the subscriber.

They are as follows:

· ICICI Prudential Pension Funds Management Company Limited

· LIC Pension Fund Ltd

· Kotak Mahindra Pension Fund Ltd

· Reliance Capital Pension Fund Ltd

· SBI Pension Fund Pvt Ltd

· UTI Retirement Solutions Ltd

· HDFC Pension Management Company

· Pension fund to be incorporated by Birla Sun Life Insurance company limited

19.Where will the funds contributed by NRIs in NPS be invested?

NRIs have option to select Pension Fund Manager and exercise investment choice under NPS All Citizen Model. The fund is invested by the selected Pension Fund Manager in the various classes of securities, as per the investment guidelines prescribed by PFRDA. The investment is usually in Equity (E), Corporate Bonds (C) and /or Government Securities (G). The individual subscriber has a choice of selecting investment mix (E,C,G), as per his/her risk appetite.

20.In what form can the contribution be made i.e. foreign exchange or Indian currency?

The contributions made by NRIs can be from either of the following sources subject to normal foreign exchange conversion norms:

– NRE Account

– NRO Account/ Local sources

21.What are the different Fund Management Schemes available to the subscriber?

The NPS offers two approaches to invest subscriber’s money:

· Active choice – Here the individual would decide on the asset classes in which the contributed funds are to be invested and their respective proportions (Asset class E- maximum of 50%, Asset Class C, and Asset Class G )

· Auto choice – Lifecycle Fund- This is the default option under NPS and wherein the management of investment of funds is done automatically based on the age profile of the subscriber. As the age of the subscriber progresses, the exposure of the fund to Equity (E) and Corporate Debt (C) is reduced and enhanced in Government securities as a risk protection measure. For full details, one may go through our website www.pfrda.org.in wherein the full details of the investment choices and fund management details are provided.

22.Can I switch from one investment scheme to another and/or Pension Fund Manager and if so, how?

Yes, NPS offers its subscribers the option to change the scheme preference. Subscriber has an option to realign his investment in asset class E, C and G based on age and future income requirement. Also, the subscriber has option to change the PFM and the investment option (active/auto choice) once a year, free of charge.

23.Is there any default Pension Fund Manager (PFM) Option provided under NPS?

Yes, there is a default PFM provision under NPS and presently, SBI Pension Funds Private

Limited is the default Pension Fund Manager.

24.Can I have a different Pension Fund Manager and Investment Option for my Tier I and

Tier II account?

Yes. You may select different PFMs and Investment Options for your NPS Tier I and Tier II

accounts.

Tax Benefits and Implications

25. For NRIs, what would be the status of repatriation of the pension/ annuity and lump sum to be paid out of the invested funds ?

When the pension/ annuity is to be paid, it shall be in local currency only (i.e. in INR). However, there is no restriction on repatriation of pension, whether paid as annuity or in lump sum. Provisions of Income Tax Act, 1961 subject to amendments from time to time, would be applicable.

26.Will payment of pension and withdrawal of the lump sum amount be treated as a current account transaction or a capital account transaction?

Since withdrawal of lump sum or payment of pension is treated as income and chargeable to Income Tax, therefore both the operations will be treated as a current account transaction.

27.What income tax reliefs are available to the individuals contributing to NPS?

Tax benefit to self-employed:

Eligible for tax deduction up to 10 % of gross income earned from Indian sources under Sec 80 CCD(1) with in the overall ceiling of Rs. 1.5 lac under Sec 80 CCE of IT Act, 1961.

Additional Tax benefit w.e.f 2015-16

From F.Y. 2015-16, subscriber are allowed extra tax deduction in addition to the deduction allowed under Sec. 80CCD(1) for additional contribution in his NPS account subject to maximum of Rs.

50,000/- under sec. 80CCD 1(B) of IT Act, 1961.

Exit & Withdrawal

28.Will NRIs have different Exit & Withdrawal rules?

No, Exit & Withdrawal rules for NRIs shall be the same as for residents under the PFRDA (Exit and Withdrawals under the National Pension System) Regulations, 2015. All forms are available at www.npscra.nsdl.co.in.

29.What are the Exit rules applicable for NRIs?

The Exit rules applicable for NRIs are

· Upon attaining the age of 60 years

· Exit from NPS before the age of 60 years

· Upon Death of the Subscriber

30.What are the applicable provisions for withdrawal of the accumulated pension wealth once I attain 60 years of age?

At least 40% of the accumulated pension wealth of the subscriber needs to be utilized for purchase of an annuity providing for the monthly pension of the subscriber and the balance is paid as a lump sum payment to the subscriber. In case, the accumulated pension wealth is equal to or less than a sum of two lakh rupees, the subscribers have the option to withdraw the entire accumulated pension wealth without purchasing any annuity.

31.What will happen to my savings if I decide to retire or do not want to continue in the NPS

before age 60?

Such a premature exit would only be allowed to subscribers who have been with the NPS for at least 10 years. In such case, at least 80% of the accumulated pension wealth of the subscriber needs to be mandatorily utilized for purchase of an annuity providing for the monthly pension of the subscriber and the balance is paid as a lump sum payment to the subscriber.

32.In the event of the death of subscriber before attaining the age of 60 years, what will be the benefit that is payable and who will get the benefits ?

In the unfortunate event of death of the subscriber, the entire accumulated pension wealth of the subscriber shall be paid to the nominee or nominees or legal heirs, as the case may be, of such subscriber. Also, the nominee or family members of the deceased subscriber shall have the option to purchase any of the annuities being offered upon exit, if they so desire.

33.How to withdraw the benefits available under NPS?

The subscriber wishing to exit from NPS has to submit a withdrawal application form to the concerned POP along with the documents specified for withdrawal of the benefits and the POP in turn would authenticate the documents and forward them to CRA – NSDL. CRA in turn would register your claim and forward you the necessary application form along with the procedure to be followed and documents that need to be submitted. Once the documents are received, CRA in consultation with NPS Trust processes the application and settles the account. . All forms are available at www.npscra.nsdl.co.in.

34.What are the documents that need to be submitted along with the withdrawal forms?

Following documents are required to be submitted along with the withdrawal forms in order to settle the claims:

1. PRAN card in original

2. Attested copy of Proof of Identity (e. g. Passport, Aadhar Card, PAN Card, Valid Driving License, Voter ID Card etc.)

3. Attested copy of Proof of Address (e. g. Passport, Aadhar Card, Valid Driving License, Voter ID Card etc.)

4. Cancelled cheque (containing Subscriber Name, Bank Account Number and IFS Code) or Bank Certificate Containing Name, Bank Account Number and IFSC code, for direct credit or electronic transfer.

Note: An illustrative list of documents acceptable as proof of identity and address can be seen at PFRDA circulars available on PFRDA’s website pfrda.org.in.

35.Can an NPS subscriber defer his lump sum withdrawable amount (up to 60%) under NPS

at the time of exit at 60 years?

Yes, one can defer the withdrawal of the eligible lump sum amount payable under NPS till the age of 70 years.

36.Upto what age can an NPS subscriber contribute beyond the age of 60 years?

The subscriber can continue to subscribe to the National Pension System beyond the age of sixty years, the age, not exceeding seventy years, until which he would like to contribute to his individual pension account.

37.Can I use more than 40% of my accumulated pension wealth to purchase the annuity at the time of exit from NPS upon attaining the age of 60 years?

Yes, a subscriber at the time of attaining the age of 60 years can purchase annuity up to 100% of his accumulated pension wealth.

38.Can a NPS subscriber defer his annuity purchase under NPS at the time of exit on 60 years?

Yes, one can defer the mandatory purchase of annuity for a maximum period of 3 years, at the time of exit from NPS.

39.What will happen to my withdrawal if my PRAN is in frozen or inactive state at the time of withdrawal?

The CRA will unfreeze the account by charging the penalty applicable and process the withdrawal claim without payment of any extra amounts by the subscriber.

Partial Withdrawals under NPS

40.Are partial withdrawals allowed under NPS?

Yes, partial withdrawals are allowed under NPS.

A partial withdrawal of accumulated pension wealth of the subscriber, not exceeding twenty-five per cent of the contributions made by the subscriber provided, that the subscriber shall have been in the National Pension System at least for a period of last ten years from the date of his or her joining.

41.What are purposes for which the partial withdrawals are allowed under NPS?

– For the purpose of higher education of his/her children,

– For marriage of his/her children,

– For purchase or construction of residential house or flat

– For treatment of specified illnesses.

42.What can be the frequency of the partial withdrawals as allowed under NPS?

The subscriber shall be allowed to withdraw only a maximum of three times during the entire tenure of subscription under the National Pension System and not less than a period of five years shall have elapsed from the last date of each of such withdrawal.

Annuity, Annuity Schemes and Annuity Service Providers

43.What is an annuity?

An annuity is a financial instrument which provides for a regular payment of a certain amount of money on monthly/quarterly/annual basis for the chosen period for a given purchase price or pension wealth. In simple terms it is a financial instrument which offers monthly/ quarterly/ annual pension at a specified rate for the period you chosen by you.

44.What are the different types of annuities providing for monthly pension available to the subscribers of NPS?

The following are the generic annuities that are offered by Annuity Service Providers to the subscribers of NPS. However, some of the ASPs may offer some variants which have slightly different or combination of annuities.

1. Pension (Annuity) payable for life at a uniform rate to the annuitant only.

2. Pension (Annuity) payable for 5, 10, 15 or 20 years certain and thereafter as long as you are alive.

3. Pension (Annuity) for life with return of purchase price on death of the annuitant

(Policyholder).

4. Pension (Annuity) payable for life increasing at a simple rate of 3% p.a.

5. Pension (Annuity) for life with a provision of 50% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

6. Pension (Annuity) for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant.

7. Pension (Annuity) for life with a provision of 100% of the annuity payable to spouse during his/her lifetime on death of the annuitant and with return of purchase price on death of the spouse. If the spouse predeceases the annuitant, payment of annuity will cease after the death of the annuitant and purchase price is paid to the nominee.

45.What are the factors that determine the annuity income when you buy an annuity?

The size of your pension wealth/corpus determines your monthly annuity/pension. Bigger the accumulated pension wealth or corpus used for purchase of annuity, the higher would be the monthly pension that is received. Besides that, amount of annuity may also vary according to the type of annuity variant selected by the subscriber.

46.What are the Annuity Service Providers under NPS and what are their names?

Indian Life Insurance companies which are licensed by Insurance Regulatory and Development Authority ( IRDA) are empanelled by PFRDA to act as Annuity Service Provider’s to provide annuity services to the subscribers of NPS. Currently, the following ASPs are empanelled by PFRDA.

2. Life Insurance Corporation of India

3. SBI Life Insurance Co. Ltd.

4. ICICI Prudential Life Insurance Co. Ltd.

5. Bajaj Allianz Life Insurance Co. Ltd.

6. Star Union Dai-ichi Life Insurance Co. Ltd.

7. Reliance Life Insurance Co. Ltd.

8. HDFC Standard Life Insurance Co. Ltd

Note: The ASP empanelment process is an ongoing process and the list of ASPs may change in future.

47.What is the default annuity scheme and default ASP under NPS?

The following default annuity service provider along with the annuity scheme is available to all the subscribers under National Pensions System.

1. Default Annuity Service Provider – Life Insurance Corporation of India (LIC)

2. Default Annuity Scheme – Annuity for life with a provision of 100% of the annuity payable to spouse during his/her life on death of annuitant and under this option, payment of monthly annuity would cease once the annuitant and the spouse die or after death of the annuitant if the spouse pre-deceases the annuitant, without any return of purchase price.

However, it may be noted that default option is being purely provided in the subscribers’ interest and to avoid any delay in claim processing and is not with a view to endorse/promote any particular ASP or annuity variant being offered by the ASP. If the amount available in NPS account of subscriber is not adequate to buy the default annuity variant and from the default ASP, the subscriber has to compulsorily choose an ASP who offers an annuity at the available corpus in the account of the subscriber.

48.How the annuity OR monthly pension is paid?

Monthly pension /Annuity will be paid through direct bank transfer to the specified subscribers account only through Annuity Service Providers.

Grievance Redressal Management System

49.I have a NPS account and have a grievance on the services provided. To whom should I

complain and how?

The subscriber can raise grievance through any of the modes mentioned below:

– Call Centre/Interactive Voice Response System (IVR)

Ø The Subscriber can contact the CRA call center at toll free telephone number

1-800-222080 and register the grievance by using T-PIN.

Ø Dedicated Call center executives.

– Physical forms direct to CRA

Ø The Subscriber may submit the grievance in a prescribed format to the POP – SP

who would forward it to CRA Central Grievance Management System (CGMS).

Ø Subscriber can directly send form to CRA.

– Web based interface

Ø The Subscriber may register the grievance at the website www.npscra.nsdl.co.in with the use of the I-pin allotted at the time of opening a Permanent Retirement Account.

Download PFRDA FAQs on National Pension System for Non resident Indians