NPS covered Central Government Employees get full Gratuity – Notification

Retirement Gratuity and Death Gratuity for NPS covered Central Government Employees notified for the very first time at par with Central Government Employees receiving Pension – Gazette Notification dated 23.09.2021

As per CCS (Pension) Rules, 1972, Central Government Employees covered by Pension Scheme are entitled to Retirement Gratuity of to the extent of 1/4th of emoluments (Basic Pay plus DA) for each completed 6 months period of qualifying Service. Maximum Retirement Gratuity payable is 16 1/2 times of emoluments or Rs. 20 lakh whichever is less.

By notifying Central Civil Services (Payment of Gratuity under National Pension System) Rules 2021, Government has extended the same benefit of Retirement and Death Gratuity for NPS covered Central Government Employees also. The details of Retirement and Death Gratuity allowed for NPS covered Central Government Employees are as follows.

Retirement Gratuity

This is payable to the retiring Government servant. A minimum of 5 years’ qualifying service and eligibility to receive service gratuity/pension is essential to get this one time lump sum benefit. Retirement gratuity is calculated @ 1/4th of a months Basic Pay plus Dearness Allowance drawn on the date of retirement for each completed six monthly period of qualifying service.

There is no minimum limit for the amount of gratuity. The retirement gratuity payable for qualifying service of 33 years or more is 16 times the Basic Pay plus DA, subject to a maximum of Rs. 20 lakhs.

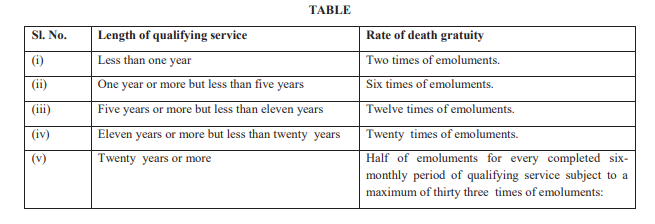

Death Gratuity

This is a one-time lump sum benefit payable to the nominee or family member of a Government servant dying in harness. There is no stipulation in regard to any minimum length of service rendered by the deceased employee. Entitlement of death gratuity is regulated as under:

| Qualifying Service | Rate |

| Less than one year | 2 times of basic pay |

| One year or more but less than 5 years | 6 times of basic pay |

| 5 years or more but less than 11 years | 12 times of basic pay |

| 11 years or more but less than 20 years | 20 times of basic pay |

| 20 years or more | Half of emoluments for every completed 6 monthly period of qualifying service subject to a maximum of 33 times of emoluments. |

Maximum amount of Death Gratuity admissible is Rs. 20 lakhs w.e.f. 1.1.2016.

Other Benefits extended to NPS covered Central Government Employees:

1. As per Central Civil Services (Implementation of National Pension System) Rules, 2021 notified on 30.03.2021, Central Government Employees covered un der National Pension System can opt for for availing benefits under the National Pension System or under the Central Civil Service (Pension) Rules, 1972 or the Central Civil Service (Extraordinary Pension) Rules, 1939 in the event of his / her death, disablement or retirement on invalidation. In such cases, the government employee / family of the employee will be entitled to pension / family pension as the case may be. In those cases, the contribution of the government in the NPS account of the such government employees along with returns will be deposited to the Government.

2. Increase in Govt’s contribution to NPS account of the central government employees increased from 10% to 14% – Check out this article for notification dated 31.03.2019 issued by Ministry of Finance

Also, read this article for important initiatives of the government in respect of NPS

MINISTRY OF PERSONNEL, PUBLIC GRIEVANCES AND PENSIONS

(Department of Pension and Pensioners’ Welfare)

NOTIFICATION

New Delhi, the 23rd September, 2021

G.S.R. 658(E). — In exercise of the powers conferred by the proviso to article 309 and clause (5) of article 148 of the Constitution and after consultation with the Comptroller and Auditor-General of India in relation to persons serving in the Indian Audit and Accounts Department, the President hereby makes the following rules, namely:-

CHAPTER I

1. Short title and commencement

(1) These rules may be called the Central Civil Services (Payment of Gratuity under National Pension System) Rules, 2021.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. Application

Save as otherwise provided in these rules, these rules shall apply to the Government servants including civilian Government servants in the Defence Services, appointed substantively to civil services and posts in connection with the affairs of the Union on or after the 1st day of January 2004, and to whom the Central Civil Services (Implementation of National Pension System) Rules, 2021 apply :

Provided that in the case of a Government servant who dies during service or is boarded out on account of disablement or retires on invalidation and who had exercised option under rule 10 of the Central Civil Services (Implementation of National Pension System) Rules, 2021 for availing benefits under the Central Civil Services (Pension) Rules, 1972 or the Central Civil Services (Extraordinary Pension) Rules, 1939, payment of gratuity shall be made in accordance with the said rules.

3. Definitions

In these rules, unless the context otherwise requires, –

(1)(a) ‘Accounts Officer’ means an officer, whatever his official designation, of a Ministry or Department functioning under the scheme of departmentalisation of accounts, who, inter-alia is responsible for receipts, payments, Internal Audit and accounting functions of an office or Department or Ministry of the Central Government or Union territory and includes officers subordinate to the Accountant General who is entrusted with the function of maintaining the accounts or part of accounts of the Central Government or Union territory;

(b) ‘allottee’ means a Government servant to whom Government accommodation has been allotted on payment of license fee or otherwise;

(c) ‘average emoluments’ means average emoluments as determined in accordance with rule 7;

(d) ‘Emoluments’ means emoluments referred to 1n rule 6;

(e) ‘Form’ means a Form appended to these rules;

(f) ‘Government’ means the Central Government;

(g) ‘Government dues’ means dues referred to in sub-rule (3) of rule 45;

(h) ‘gratuity’ includes retirement gratuity and death gratuity payable under these rules;

(i) ‘Minor’ means a person who has not completed the age of eighteen years;

(j) ‘Qualifying service’ means the service rendered while on duty or otherwise which shall be taken into account for the purpose of payment of gratuity admissible under these rules;

(k) ‘Service Book’ includes service roll, if any.

(2) Words and expressions used herein and not defined but defined in the Fundamental Rules, 1922 or the Central Civil Services (Implementation of National Pension System) Rules, 2021 shall have the meanings as respectively assigned to them in those rules.

CHAPTER II

GENERAL CONDITIONS

4. Regulation of claims to gratuity

(1) Any claim to gratuity shall be regulated by the provisions of these rules in force at the time when a Government servant retires or is retired or is discharged or is allowed to resign from service or dies, as the case may be.

(2) The day on which a Government servant retires or is retired or is discharged or is allowed to resign from service, as the case may be, shall be treated as his last working day and the date of death of a Government servant shall also be treated as a working day.

5. Right of President to withhold gratuity

(1) The President reserves to himself the right of withholding gratuity, either in full or in part, and of ordering recovery from gratuity of the whole or part of any pecuniary loss caused to the Government, if, in any departmental or judicial proceedings instituted while the Government servant was in service, the retired Government servant is found guilty of grave misconduct or negligence :

Provided that the Union Public Service Commission shall be consulted before any final orders are passed by the President under this rule:

(2) (a) The departmental proceedings referred to in sub-rule (1), shall, after the retirement of the Government servant, be deemed to be proceedings under this rule and shall be continued and concluded by the authority by which they were commenced in the same manner as if the Government servant had continued in service :

Provided that in all cases where the departmental proceedings are instituted by an authority subordinate to the President, that authority shall submit a report recording its findings to the President.

(b) No gratuity shall be payable to the Government servant until the conclusion of the departmental or judicial proceedings referred to in sub-rule (1) and issue of final orders thereon.

(3) The President may at any time, either on his own motion or otherwise call for the records of any inquiry and revise any order made under these rules and may confirm, modify or set aside the order, or remit the case to an authority directing such authority to make such further enquiry as it may consider proper in the circumstances of the case, or pass such other order as he may deem fit :

Provided that no order enhancing the amount of gratuity to be withheld or withdrawn, shall be made.

(4) The President may at any time, either on his own motion or otherwise review any order passed under these rules, where extenuating or special circumstances exist to warrant such review or when any new material or evidence which could not be produced or was not available at the time of passing of the order under review and which has the effect of changing the nature of the case, has come, or has been brought, to his notice :

Provided that no order enhancing the amount of gratuity to be withheld or withdrawn, shall be made.

(5) For the purpose of this rule, –

(a) departmental proceedings shall be deemed to be instituted on the date on which the statement of charges is issued to the Government servant or pensioner, or if the Government servant has been placed under suspension from an earlier date, on such date ; and

(b) judicial proceedings shall be deemed to be instituted —

(i) in the case of criminal proceedings, on the date on which the complaint or report of a police officer, of which the Magistrate takes cognizance, is made, and

(ii) in the case of civil proceedings, on the date the plaint is presented in the court.

CHAPTER III

EMOLUMENTS AND AVERAGE EMOLUMENTS

6. Emoluments

(1) The expression ’emoluments’ for the purpose of determining the amount of gratuity payable under these rules shall include the basic pay as defined in rule 9 (21) (a) (i) of the Fundamental Rules, 1922, which a Government servant was receiving immediately before his retirement or on the date of his death and shall also include non-practicing allowance granted to medical officer in lieu of private practice.

Explanation. – For the purposes of this sub-rule, stagnation increment shall be treated as emoluments for calculation of gratuity.

(2) Where a Government servant immediately before his retirement or death while in service had been absent from duty or was on leave for which leave salary is payable or having been suspended had been reinstated without forfeiture of service, the emoluments which he would have drawn had he not been absent from duty or suspended shall be the emoluments for the purposes of this rule:

Provided that any increase in pay [ other than the increment referred to in sub-rule (5)] which is not actually drawn shall not form the part of his emoluments.

(3) Where a Government servant immediately before his retirement or death while in service had proceeded on leave for which leave salary is payable after having held a higher appointment whether in an officiating or temporary capacity, the benefit of emoluments drawn in such higher appointment shall be given only if it is certified that the Government servant would have continued to hold the higher appointment but for his proceeding on leave.

(4) Where a Government servant immediately before his retirement or death while in service had been absent from duty on extraordinary leave or had been under suspension, the period whereof does not count as service, the emoluments which he drew immediately before proceeding on such leave or being placed under suspension shall be the emoluments for the purposes of this rule.

(5) Where a Government servant immediately before his retirement or death while in service, was on earned leave, and earned an increment which was not withheld, such increment though not actually drawn, shall form part of his emoluments :

Provided that the increment was earned during the currency of the earned leave not exceeding one hundred and twenty days, or during the first one hundred and twenty days of earned leave where such leave was for more than one hundred and twenty days.

(6) Pay drawn by a Government servant while on deputation to another Central Government Department and to the Armed Forces of India shall be treated as emoluments.

(7) Pay drawn by a Government servant while on foreign service shall not be treated as emoluments, and the pay which he would have drawn under the Government had he not been on foreign service shall alone be treated as emoluments.

(8) Where a pensioner who is re-employed in Government service and whose pay on re-employment has been reduced by an amount not exceeding his monthly pension, the element of monthly pension by which his pay is reduced shall be treated as emoluments.

7. Average emoluments

(1) Average emoluments shall be determined with reference to the emoluments drawn by a Government servant during the last ten months of his service.

(2) Where during the last ten months of his service, a Government servant had been absent from duty on leave for which leave salary is payable or having been suspended had been reinstated without forfeiture of service, the emoluments which he would have drawn had he not been absent from duty or suspended shall be taken into account for determining the average emoluments :

Provided that any increase in pay [ other than the increment referred to in sub-rule (4)] which is not actually drawn shall not form the part of his emoluments.

(3) Where during the last ten months of his service, a Government servant had been absent from duty on extraordinary leave, or had been under suspension the period whereof does not count as service, the aforesaid period of leave or suspension shall be disregarded in the calculation of the average emoluments and equal period before the ten months shall be included and in order that the fractions of a month, when added, worked out to one full month, a month for this purpose shall be reckoned as consisting of thirty days.

(4) Where a Government servant who was on earned leave during the last ten months of his service and earned an increment, which was not withheld, such increment though not actually drawn shall be included in the average emoluments :

Provided that the increment was earned during the currency of the earned leave not exceeding one hundred and twenty days or during the first one hundred and twenty days of earned leave where such leave was for more than one hundred and twenty days.

CHAPTER IV

QUALIFYING SERVICE

8. Commencement of qualifying service

Subject to the provisions of these rules, qualifying service of a Government servant shall commence from the date he takes charge of the post to which he is first appointed either substantively or in an officiating or temporary capacity :

Provided that officiating or temporary service is followed without interruption by substantive appointment in the same or another service or post.

9. Conditions subject to which service qualifies

(1) The service of a Government servant shall not qualify, unless his duties and pay are regulated by the Government, or under conditions determined by the Government.

Explanation. – For the purposes of this sub-rule, the expression “service” means service under the Government and paid by that Government from the Consolidated Fund of India or a Local Fund administered by that Government.

(2) In the case of Government servant belonging to a State Government who is permanently transferred to a service or post to which these rules apply, the continuous service rendered under the State Government in an officiating or temporary capacity, if any, followed without interruption by substantive appointment, or the continuous service rendered under that Government in an officiating or temporary capacity, as the case may be, shall qualify.

10. Counting of service on probation

Service on probation against a post if followed by confirmation in the same or another post shall qualify.

11. Counting of service as apprentice

Service as an apprentice shall not qualify, except in the case of Subordinate Audit or Account Services (S.A.S.) apprentice in the Indian Audit and Accounts Department or the Defence Accounts Department.

12. Counting of periods spent on leave

All leave during service for which leave salary is payable and all extraordinary leave granted on medical certificate shall count as qualifying service:

Provided that in the case of extraordinary leave other than extraordinary leave granted on medical certificate the appointing authority may, at the time of granting such leave, allow the period of that leave to count as qualifying service if such leave is granted to a Government servant, –

(i) due to his inability to join or rejoin duty on account of civil commotion; or

(ii) for pursuing higher studies considered useful in discharge of the official duty of the Government servant.

13. Counting of periods spent on training

(1)The Government may, by order, decide whether the time spent by a Government servant under training immediately before appointment to a Group ‘A’ or Group ‘B’ post under the Government shall count as qualifying service.

(2) Time spent by a Government servant under training immediately before appointment to a Group ‘C’ post under the Government shall count as qualifying service.

(3) Group ‘C’ employees, who are required to undergo departmental training relating to jobs before they are put on regular employment, training period may be treated as qualifying service for gratuity, if the training is followed immediately by an appointment and the benefit shall be admissible to Group ‘C’ employees even if the officers concerned are not given the scale of pay of the post but only a nominal allowance.

14. Counting of periods of suspension

Time passed by a Government servant under suspension pending inquiry into conduct shall count as qualifying service where, on conclusion of such inquiry, he has been fully exonerated or a minor penalty is imposed on the Government servant or the suspension is held to be wholly unjustified; in other cases, the period of suspension shall not count unless the authority competent to pass orders under the rule governing such cases expressly declares at the time that it shall count to such extent as the Competent Authority may declare.

15. Forfeiture of service on dismissal or removal

Dismissal or removal of a Government servant from a service or post entails forfeiture of his past service.

16. Counting of past service on reinstatement

(1) A Government servant who is dismissed, removed or compulsorily retired from service, but is reinstated on appeal or review, is entitled to count his past service as qualifying service.

(2) The period of interruption in service between the date of dismissal, removal or compulsory retirement, as the case may be, and the date of reinstatement, and the period of suspension, if any, shall not count as qualifying service unless regularised as duty or leave by a specific order of the authority which passed the order of reinstatement.

17. Forfeiture of service on resignation

(1) Resignation from a service or a post, unless it is allowed to be withdrawn in the public interest by the appointing authority, entails forfeiture of past service.

(2) A resignation shall not entail forfeiture of past service if it has been submitted to take up, with proper permission, another appointment, whether temporary or permanent, under the Government where service qualifies.

(3) Interruption in service in a case falling under sub-rule (2), due to the two appointments being at different stations, not exceeding the joining time permissible under the rules of transfer, shall be covered by grant of leave of any kind due to the Government servant on the date of relief or by formal condonation by present organization to the extent to which the period is not covered by leave due to him.

(4) Where an order is passed by the appointing authority under Central Civil Services (Implementation of National Pension System ) Rules, 2021, allowing a person to withdraw his resignation and to resume duty, the order shall be deemed to include the condonation of interruption in service but the period of interruption shall not count as

qualifying service.

(5) A resignation submitted for the purpose of rule 32 shall not entail forfeiture of past service under the Government.

18. Effect of interruption in service

(1) An interruption in the service of a Government servant entails forfeiture of his past service, except in the following cases, namely :-

(a) authorised leave of absence ;

(b) unauthorised absence in continuation of authorised leave of absence so long as the post of absentee is not filled substantively ;

(c) suspension, where it is immediately followed by reinstatement, whether in the same or a different post, or where the Government servant dies or is permitted to retire or is retired on attaining the age of compulsory retirement while under suspension ;

(d) transfer to non-qualifying service in an establishment under the control of the Government if such transfer has been ordered by a competent authority in the public interest ;

(e) joining time while on transfer from one post to another.

(2) Notwithstanding anything contained in sub-rule (1), the appointing authority may, by order, commute retrospectively the periods of absence without leave as extraordinary leave.

19. Condonation of interruption in service

(1) In the absence of a specific indication to the contrary in the service book, an interruption between two spells of civil service rendered by a Government servant under Government including civil service rendered and paid out of Defence Services Estimates or Railway Estimates shall be treated as automatically condoned and the pre-interruption service treated as qualifying service.

(2) Nothing in sub-rule (1) shall apply to interruption caused by resignation, dismissal or removal from service or for participation in a strike.

(3) The period of interruption referred to in sub-rule (1) shall not count as qualifying service.

20. Period of deputation

Service rendered by a Government servant on foreign service in India or abroad or on deputation to United Nations or other International organisations shall count as qualifying service for gratuity provided contributions in respect of gratuity have been deposited for the said period either by the Government servant himself or by the foreign employer.

Explanation.- For the purposes of this rule, the rate of contribution for counting of period as qualifying service for the purpose of grant of gratuity shall be regulated in accordance with the instructions issued by the Department of Personnel and Training from time to time.

21. Verification of qualifying service after eighteen years’ service and five years before retirement

(1) On each occasion after a Government servant has completed eighteen years of service and on his being left with five years of service before the date of superannuation, the Head of Office in consultation with Accounts Officer shall, in accordance with the rules for the time being in force, verify the service rendered by such a Government servant, determine the qualifying service and communicate to him, in Form 1, the period of qualifying service so determined.

(2) Notwithstanding anything contained in sub-rule (1), where a Government servant is transferred to another Department from a temporary Department or on account of the closure of the Department he had been previously serving or because the post he held had been declared surplus, the verification of his service may be done whenever such event occurs.

(3) The verification done under sub-rules (1) and (2) shall be treated as final and shall not be reopened except when necessitated by a subsequent change in the rules and orders governing the conditions under which the service qualifies for gratuity.

CHAPTER V

Regulation of Retirement Gratuity and Death Gratuity

22. Retirement gratuity or death gratuity

(1) A Government servant, who has completed five years’ qualifying service and who, –

(i) retires on attaining the age of superannuation, or on invalidation, or

(ii) retires or is retired, in advance of the age of superannuation in accordance with rule 56 of the Fundamental Rules, 1922 or rule 12 of the Central Civil Services (Implementation of National Pension System) Rules, 2021; or

(iii) on being declared surplus to the establishment in which he was serving, opts for Special Voluntary Retirement Scheme relating to voluntary retirement of surplus employees; or

(iv) on has been permitted to be absorbed in a service or post in or under a Corporation or Company wholly or substantially owned or controlled by the Central Government or a State Government or in or under a body controlled or financed by the Central Government or a State Government, shall, on his retirement, be granted retirement gratuity equal to one-fourth of his emoluments for each completed six monthly period of qualifying service, subject to a maximum of 16½ times the emoluments.

(2) Where a Government servant dies while in service, the death gratuity shall be payable to his family in the manner indicated in sub-rule (1) of rule 24 at the rates given in the following Table, namely : –

Provided that the amount of retirement gratuity or death gratuity payable under this rule shall in no case exceed twenty lakh rupees:

Provided further that where the amount of retirement or death gratuity as finally calculated contains a fraction of a rupee, it shall be rounded off to the next higher rupee.

(3) The emoluments for the purpose of gratuity admissible under this rule, shall be reckoned in accordance with rule 6:

Provided that if the emoluments of a Government servant have been reduced during the last ten months of his service otherwise than as a penalty, average emoluments as referred to in rule 7 shall be treated as emoluments:

Provided further that the dearness allowance admissible on the date of retirement or death, as the case may be, shall also be treated as emoluments for the purpose of this rule.

(4) Where a Government servant, who has become eligible for retirement gratuity dies within five years from the date of his retirement from service including compulsory retirement as a penalty and the sums actually received by him at the time of death on account of such annuity under National Pension System, if any, together with the retirement gratuity admissible under sub –rule (1) are less that the amount equal to twelve times of his emoluments, a residuary gratuity equal to the deficiency may be granted to his family in the manner indicated in sub-rule (1) of rule 24.

(5) For the purposes of this rule and rules 23, 24, 25 and 26, ‘family’, in relation to a Government servant, means, –

(i) wife or wives including judicially separated wife or wives in the case of a male Government servant;

(ii) husband, including judicially separated husband in the case of a female Government servant;

(iii) sons including stepsons and adopted sons;

(iv) unmarried daughters including stepdaughters and adopted daughters;

(v) widowed or divorced daughters including stepdaughters and adopted daughters;

(vi) father, including adoptive parents in the case of individuals whose personal law permits adoption;

(vii) mother, including adoptive parents in the case of individuals whose personal law permits adoption;

(viii) brothers below the age of eighteen years including stepbrothers;

(ix) unmarried sisters and widowed sisters including stepsisters;

(x) married daughters, and

(xi) children of a pre-deceased son.

Explanation. – (1) In calculating the length of qualifying service, fraction of a year equal to three months and above shall be treated as a completed one half-year and reckoned as qualifying service.

(2) Death gratuity shall also be admissible in the case of a Government servant who commits suicide.

23. Nominations

(1) A Government servant shall, on his initial confirmation in a service or post, make a nomination in Form 2, conferring on one or more persons the right to receive the retirement gratuity or death gratuity payable under rule 22 :

Provided that if at the time of making the nomination, –

(i) the Government servant has a family, the nomination shall not be made in favour of any person or persons other than the members of his family ; or

(ii) the Government servant has no family, the nomination may be made in favour of a person or persons, or a body of individuals, whether incorporated or not.

(2) Where a Government servant nominates more than one person under sub-rule (1), he shall specify in the nomination the amount of share payable to each of the nominees, in such manner as to cover the entire amount of

gratuity.

(3) A Government servant may provide in the nomination, –

(i) that in respect of any specified nominee who predeceases the Government servant, or who dies after the death of the Government servant but before receiving the payment of gratuity, the right conferred on that nominee shall pass to such other person as may be specified in the nomination :

Provided that if at the time of making the nomination the Government servant has a family consisting of more than one member, the person so specified shall not be a person other than a member of his family :

Provided further that where a Government servant has only one member in his family, and a nomination has been made in his favour, it is open to the Government servant to nominate alternate nominee or nominees in favour of any person or a body of individuals, whether incorporated or not ;

(ii) that the nomination shall become invalid in the event of the happening of the contingency provided therein.

(4) The nomination made by a Government servant who has no family at the time of making it, or the nomination made by a Government servant under the second proviso to clause (i) of sub-rule (3) where he has only one member in his family shall become invalid in the event of the Government servant subsequently acquiring a family, or an additional member in the family, as the case may be.

(5) A Government servant may, at any time, cancel a nomination by sending a notice in writing to the Head of Office Provided that he shall, along with such notice, send a fresh nomination made in accordance with this rule.

(6) Immediately on the death of a nominee in respect of whom no special provision has been made in the nomination under clause (i) of sub-rule (3) or on the occurrence of any event by reason of which the nomination becomes invalid in pursuance of clause (ii) of sub-rule (3), the Government servant shall send to the Head of Office a notice in writing cancelling the nomination together with a fresh nomination made in accordance with this rule.

(7) (a) Every nomination made including every notice of cancellation, if any, given by a Government servant under this rule, shall be sent to the Head of Office.

(b) The Head of Office shall, immediately on receipt of such nomination, verify that the nomination made by the Government servant is in accordance with the provisions of this rule and, if the Government servant has a family, the nomination made is in favour of one or more members of the family as referred to in sub-rule (5) of rule 22 and the Head of Office shall, thereafter, countersign the nomination indicating the date of receipt and keep it under his custody :

Provided that the Head of Office may authorise his subordinate Gazetted Officers to countersign nomination forms of non-Gazetted Government servants.

(c) Suitable entry regarding receipt of nomination shall be made in the service book of the Government servant concerned.

(8) Every nomination made, and every notice of cancellation given, by a Government servant shall, to the extent that it is valid, take effect from the date on which it is received by the Head of Office.

24. Persons to whom gratuity is payable

(1) (a) The gratuity payable under rule 22 shall be paid to the person or persons on whom the right to receive the gratuity is conferred by means of a nomination under rule 23;

(b) If there is no such nomination or if the nomination made does not subsist, the gratuity shall be paid in the following manner, namely : –

(A) if there are one or more surviving members of the family as specified in clauses (i), (ii), (iii), (iv) and (v) of sub-rule (5) of rule 22, to all such members in equal shares;

(B) if there are no such surviving members of the family as specified in sub-clause (A), but there are one or more members as specified in clauses (vi), (vii), (viii), (ix), (x) and (xi) of sub-rule (5) of rule 22, to all such members in equal shares.

(2) If a Government servant dies after retirement without receiving the gratuity admissible under sub-rule (1) of rule 22 the gratuity shall be disbursed to the family in the manner provided in sub-rule (1).

(3) The right of a female member of the family, or that of a brother, of a Government servant who dies while in service or after retirement, to receive the share of gratuity shall not be affected if the female member marries or re- marries, or the brother attains the age of eighteen years, after the death of the Government servant and before receiving her or his share of the gratuity.

(4) Where gratuity is granted under rule 22 to a minor member of the family of the deceased Government servant, it shall be payable to the guardian on behalf of the minor.

Explanation.- (1) Payment of the minor’s share of gratuity shall be made to the natural guardian of the minor, if any and in the absence of a natural guardian, the payment of minor’s share of gratuity shall be made to the person who furnishes a certificate of guardianship.

(2) In the absence of a natural guardian, the payment of twenty per cent. of minor’s share of gratuity may be made to the guardian without the production of a guardianship certificate but on production of an indemnity bond in Proforma A and the balance amount of minor’s share of gratuity may be paid to the guardian on production of the certificate of guardianship.

(3) The share of the gratuity payable to a member of the family who has died or become disqualified before receiving actual payment, shall be distributed equally among the remaining members of the family in accordance with clause (b) of sub-rule (1) of rule 24.

(4) Disbursing authorities shall ascertain, before making actual payment of a death or retirement gratuity whether all the member of the family in whose favour the sanction was issued have continued to be qualified. If not, and also if any of them is dead, the fact shall be reported immediately to the sanctioning authority for the issue of a revised sanction in favour of the remaining members of the family.

25. Debarring a person from receiving gratuity

(1) Where a person who in the event of death of a Government servant while in service is eligible to receive gratuity in terms of rule 24, is charged with the offence of murdering the Government servant or for abetting in the commission of such an offence, his claim to receive his share of gratuity shall remain suspended till the conclusion of the criminal proceedings instituted against him.

(2) Where on the conclusion of the criminal proceedings referred to in sub-rule (1), the person concerned, –

(a) is convicted for the murder or abetting in the murder of the Government servant, he shall be debarred from receiving his share of gratuity which shall be payable to other eligible members of the family, if any;

(b) is acquitted of the charge of murdering or abetting in the murder of the Government servant, his share of gratuity shall be payable to him.

(3) The provisions of sub-rule (1) and sub-rule (2) shall also apply to the undisbursed gratuity referred to in sub-rule (2) of rule 24.

26. Lapse of retirement gratuity or death gratuity

Where a Government servant dies while in service or after retirement without receiving the amount of gratuity and leaves behind no family, and, –

(a) has made no nomination; or

(b) the nomination made by him does not subsist, the amount of retirement gratuity or death gratuity payable in respect of such Government servant under rule 22 shall lapse to the Government :

Provided that the amount of death gratuity or retirement gratuity shall be payable to the person in whose favour a Succession Certificate in respect of the gratuity in question has been granted by a Court of Law.

27. Superannuation gratuity

A superannuation gratuity shall be granted in accordance with rule 22 to a Government servant who is retired on his attaining the age of superannuation or, if the service of the Government servant has been extended beyond superannuation, on expiry of such period of extension of service beyond the age of superannuation.

28. Invalid gratuity

An Invalid Gratuity shall be granted in accordance with rule 22 to a Government servant who retires from the service on account of any bodily or mental infirmity which permanently incapacitates him for the service in accordance with rule 16 of the Central Civil Services ( Implementation of National Pension System) Rules, 2021 and who had exercised option or in whose case the default option under rule 10 of that rules, is for availing benefits under National Pension System:

Provided that where a Government servant, who had exercised option or in whose case the default option under rule 10 of the Central Civil Services (Implementation of National Pension System) Rules, 2021 is for availing benefits under the Central Civil Services (Pension) Rules, 1972 or the Central Civil Services (Extraordinary Pension) Rules, 1939 and in whose case the provision of section 20 of the Rights of Persons with Disabilities Act, 2016 (49 of 2016) are not applicable, retires on account of any bodily or mental infirmity which permanently incapacitates him for the service, further action will be taken by the Head of Office for disbursement of benefits in accordance with the Central Civil Services (Pension) Rules, 1972 or the Central Civil Services (Extraordinary Pension) Rules,1939 as the case may be.

29. Retiring gratuity

A Government servant who retires or is retired, in advance of the age of superannuation in accordance with rule 56 of the Fundamental Rules, 1922 or rule 12 of the Central Civil Services ( Implementation of National Pension System) Rules, 2021 on being declared surplus to the establishment in which he was serving, opts for Special Voluntary Retirement Scheme for surplus employees notified by the Department of Personnel and Training vide Office Memorandum No. 25013/6/2001-Estt. (A), dated the 28th February, 2002 as amended from time to time, shall be entitled to gratuity admissible under rule 22.

30. Gratuity on compulsory retirement

(1) A Government servant compulsorily retired from service as a penalty may be granted, by the authority competent to impose such penalty, gratuity at a rate not less than two-thirds of gratuity admissible to him on the date of his compulsory retirement.

(2) Whenever in the case of a Government servant the President passes an order (whether original, appellate or in exercise of power of review) awarding a gratuity less than the full gratuity admissible under these rules, the Union

Public Service Commission shall be consulted before such order is passed.

31. Effect of dismissal or removal

A Government servant who is dismissed or removed from service shall forfeit his gratuity :

Provided that the authority competent to dismiss or remove him from service may, if the case is deserving of special consideration, sanction a compassionate gratuity not exceeding two – thirds of retirement gratuity calculated at the rates mentioned in sub-rule (1) of rule 22.

32. Benefit on absorption in or under a corporation, company or body

(1) A Government servant who has been permitted to be absorbed in a service or post in or under a corporation or company wholly or substantially owned or controlled by the Central Government or a State Government or in or under a body controlled or financed by the Central Government or a State Government, shall be deemed to have retired from service from the date of such absorption and, subject to sub-rule (4), he shall be eligible, on such absorption, to receive retirement gratuity on the basis of the qualifying service and emoluments on the date of absorption in accordance with rule 22 :

Provided that on retirement from such corporation or company or body, the total amount of gratuity in respect of the service rendered under the Government and the service rendered in such corporation or company or body shall not exceed the amount that would have been admissible had the Government servant continued in Government service and retired on the same pay which he drew on retirement from that corporation or company or body.

(2) The provisions of sub-rule (1) shall also apply to Central Government servants who are permitted to be absorbed in joint sector undertakings, wholly under the joint control of the Central Government and State Governments or Union territory Administrations or under the joint control of two or more State Governments or Union territory Administrations.

(3) (a) where a Government employee joins a corporation or company or body on immediate absorption basis, the relieving order shall be issued in the Form 3 and the relieving order shall indicate the period within which the Government servant shall join the corporation or company or body :

Provided that this period may be extended by the relieving authority for reasons beyond the control of the Government servant, which shall be recorded in writing.

(b) The period between the date of relief and the date of joining in the corporation or company or body may be regularised by grant of leave due and if no such leave is due, the period may be regularised by grant of extraordinary leave.

(c) The relieving authority, before processing the case for sanction of retirement benefits, shall ascertain the date of joining by the Government servant in the corporation or company or body and accept the resignation of the Government servant from the date preceding the date of joining.

(d) No lien of the Government servant shall be retained in the relieving Department and all his connections with the Government shall stand severed on his absorption in the corporation or company or body.

(4) Where a gratuity scheme similar to the gratuity scheme under these rules exists in a body controlled or financed by the Central Government or a State Government in which a Government servant is absorbed, he shall be entitled to exercise option either, –

(a) to receive retirement benefits for the service rendered under the Central Government in accordance with sub-rule (1); or

(b) to count the service rendered under the Central Government in that body for pension.

(5) Where a Government servant is absorbed in a body controlled or financed by the Central Government or a State Government and exercises an option under clause (b) of sub-rule (4), the Government shall discharge its gratuity liability by paying in lump sum as a one time payment and the gratuity liability shall be the capitalized value of retirement gratuity for the service up to the date of absorption in that body.

(6) The date of absorption shall be determined in accordance with the provisions of rule 15 of the Central Civil Services (Implementation of National Pension System) Rules, 2021.

Explanation. – For the purpose of this rule, the expression ‘body’ means an autonomous body or a statutory body.

33. Payment of gratuity in the case of missing Government servant

(1) Where a Government servant is missing, the family shall lodge a complaint with the concerned police station and obtain report from the police, that the Government servant has not been traced despite all efforts made by the police and the report may be the First Information Report or any other report such as Daily Diary or General Diary Entry.

(2) The family after six months of lodging police complaint may apply in Form 4 for the grant of retirement gratuity to the Head of Office of the organisation where the Government servant had last served.

(3) The retirement gratuity may be sanctioned by the concerned Ministry or Department after observing the following formalities, namely:-

(i) ensure that the complaint lodged with the police and non traceable report given by the police with regard to Government servant is correct.

(ii) an Indemnity bond in Proforma- B shall be taken from the nominee or dependents of the Government servant that the retirement gratuity shall be adjusted against the payment due to the Government servant in case he appears on the scene and makes any claim.

(4) (a) The Head of Office shall process the case in Form 5 for grant of retirement gratuity.

(b) The retirement gratuity shall be paid to the family within three months of the date of application and in case of any delay, the interest shall be paid at the applicable Public Provident Fund rates and responsibility for delay shall be fixed in accordance with rule 44.

(c) The difference between the death gratuity and retirement gratuity shall be payable after the death of the employee is conclusively established or on the expiry of the period of seven years from the date of the police report.

(5) The Head of Office shall assess all the Government dues outstanding against the Government servant and effect their recovery in accordance with rule 45 before sanctioning the payment of gratuity.

CHAPTER VI

DETERMINATION AND AUTHORISATION OF THE AMOUNT OF GRATUITY

34. Preparation of papers for payment of gratuity

Every Head of Office shall undertake the work of preparation of papers for grant of gratuity in Form 6 one year before the date on which a Government servant is due to retire on superannuation, or on the date on which he proceeds on leave preparatory to retirement, whichever is earlier.

35. Intimation to the directorate of estates regarding issue of ‘No Demand Certificate’

(1) The Head of Office shall write to the Directorate of Estates at least one year before the anticipated date of retirement of the Government servant who was or is in occupation of a Government accommodation (hereinafter referred to as allottee) for issuing a `No demand certificate’ in respect of the period preceding eight months of the retirement of the allottee in accordance with rule 22 of the Central Civil Services ( Implementation of National Pension System) Rules, 2021.

36. Stages for the completion of papers for payment of gratuity on superannuation

(1) The Head of Office shall divide the period of preparatory work of one year referred to in rule 34 in the following three stages, namely:–

(a) First Stage. – Verification of service.- (i) The Head of Office shall go through the service book of the Government servant and satisfy himself as to whether the certificates of verification for the service subsequent to the service verified under rule 21 are recorded therein.

(ii) In respect of the unverified portion or portions of service, he shall verify the portion or portions of such service, as the case may be, based on pay bills, acquittance rolls or other relevant records such as last pay certificate, pay slip for month of April which shows verification of service for the previous financial year and record necessary certificates in the service book.

(iii) Where the service for any period is not capable of being verified in the manner specified in sub -clause (i) and sub-clause (ii), that period of service having been rendered by the Government servant in another office or Department, the Head of Office under which the Government servant is at present serving shall refer the said period of service to the Head of Office in which the Government servant is shown to have served during that period for the purpose of verification.

(iv) On receipt of communication referred to in sub-clause (iii), the Head of Office in that office or Department shall verify the portion or portions of such service, in the manner as specified in sub-clause (ii), and send necessary certificates to the referring Head of Office within two months from the date of receipt of such a reference:

Provided that in case a period of service is incapable of being verified, it shall be brought to the notice of the referring

Head of Office simultaneously.

(v) Where no response is received within the time period referred to in the sub -clause (iv), such period or periods shall be deemed to qualify for gratuity.

(vi) Where at any time, it is found that the Head of Office and other concerned authorities had failed to communicate any non-qualifying period of service, the Secretary of the administrative Ministry or Department shall fix responsibility for such non-communication.

(vii) The process specified in sub-clauses (i), (ii), (iii), (iv) and (v) shall be completed eight months before the date of superannuation of the Government servant.

(viii) Where any portion of service rendered by a Government servant is not capable of being verified in the manner specified in sub-clause (i) or sub-clause (ii) or sub-clause (iii) or sub-clause (iv) or sub-clause (v), the Government servant shall be asked to file a written statement on plain paper within a month, stating that he had in fact rendered service for that period, and shall, at the foot of the statement, make and subscribe to a declaration as to the truth of that statement.

(ix) The Head of Office shall, after taking into consideration the facts in the written statement referred to in sub- clause (viii) admit that portion of service as having been rendered for the purpose of calculating the gratuity of that Government servant.

(x) Where a Government servant is found to have given any incorrect information willfully, which makes him or her entitled to any benefits which he or she is not otherwise entitled to, it shall be construed as a grave misconduct.

(b) Second Stage. – Making good an omission in the service book. – (i) The Head of Office while scrutinizing the certificates of verification of service, shall also identify if there are any other omissions, imperfections or deficiencies which have a direct bearing on the determination of emoluments and the service qualifying for gratuity.

(ii) Every effort shall be made to complete the verification of service, as specified in clause (a) and to make good the omissions, imperfections or deficiencies referred to in sub-clause (i).

(iii) Any omission, imperfection or deficiency which is incapable of being made good and the periods of service about which the Government servant has submitted no statement and the portion of service shown as unverified in the service book which it has not been possible to verify in accordance with the procedure laid down in clause (a) shall be ignored and service qualifying for gratuity shall be determined on the basis of the entries in the service book.

(iv) For the purpose of calculation of average emoluments, the Head of Office shall verify from the service book the correctness of the emoluments drawn or to be drawn during the last ten months of service.

(v) In order to ensure that the emoluments during the last ten months of service have been correctly shown in the service book, the Head of Office may verify the correctness of emoluments only for the period of twenty -four months preceding the date of retirement of a Government servant, and not for any period prior to that date.

(c) Third Stage. – As soon as the second stage is completed, but not later than eight months prior to the date of retirement of the Government servant, the Head of Office shall, –

(i) furnish to the retiring Government servant a certificate regarding the length of qualifying service proposed to be admitted for the purpose of gratuity and also the emoluments and the average emoluments proposed to be reckoned for retirement gratuity.

(ii) direct the retiring Government servant to furnish to the Head of Office the reasons for non-acceptance, supported by the relevant documents in support of his claim within two months if the certified service and emoluments as indicated by the Head of Office are not acceptable to him.

37. Completion of Part I of Form 6

In cases under sub-rule (1) of rule 36, the Head of Office shall complete Part I of Form 6 not later than four months before the date of retirement of a Government servant and in cases where Government servant retiring for reasons other than superannuation, the Head of Office shall complete Part I of Form 6 within two months after retirement of a Government servant.

38. Forwarding of Form 6 and Form 7 papers for payment of gratuity to Accounts Officer

(1) After complying with the requirement of rule 36 and rule 37, the Head of Office shall forward Form 6 duly completed with a covering letter in Form 7 along with service book of the Government servant duly completed, up to date, and any other documents relied upon for the verification of service to the Accounts Officer .

(2) The Head of Office shall retain a copy of Form 6 and Form 7 for his record.

(3) The Forms referred to in sub-rule (1) shall be forwarded to the Accounts Officer not later than four months before the date of superannuation of a Government servant and in cases other than retirement on superannuation not later than two months after the date of retirement of Government servant.

39. Intimation to Accounts Officer regarding any event having bearing on gratuity

Where after the Forms for payment of gratuity have been forwarded to the Accounts Officer, any event occurs which has a bearing on the amount of gratuity admissible, the fact shall be promptly reported to the Accounts Officer by the Head of Office.

40. Intimation of the particulars of government dues to the Accounts Officer

(1) The Head of Office shall, after ascertaining and assessing the Government dues referred to in rule 45, furnish the particulars thereof to the Accounts Officer in Form 7.

(2) Where after the particulars of Government dues have been intimated to the Accounts Officer under sub-rule (1), any additional Government dues come to the notice of the Head of Office, such dues shall be promptly reported to the Accounts Officer.

41. Provisional gratuity for reasons other than Departmental or Judicial proceedings

(1) Where in spite of following the procedure laid down in rule 36, it is not possible for the Head of Office to forward the Forms for gratuity to the Accounts Officer within the period specified in sub-rule (3) of rule 38 or where the Forms for payment of gratuity have been forwarded to the Accounts Officer within the period so specified but the Accounts Officer may have returned the Forms to the Head of Office for eliciting further information before issuing order for the payment of gratuity and the Government servant is likely to retire before his gratuity can be finally assessed and settled in accordance with the provisions of these rules, the Head of Office shall rely upon such information as may be available in the official records, and without delay, determine the amount of provisional retirement gratuity.

(2) In a case of retirement otherwise than on superannuation, the Head of Office shall sanction provisional retirement gratuity within two months till final assessment of retirement gratuity

(3) Where the amount of gratuity cannot be determined for reasons other than the Departmental or Judicial proceedings, the Head of Office shall, –

(a) issue a letter of sanction addressed to the Accounts Officer endorsing a copy thereof to the Government servant authorising hundred per cent. of the gratuity as provisional gratuity and withholding of ten per cent. of gratuity;

(b) specify in the letter of sanction the amount recoverable from the gratuity under sub-rule (1) of rule 40 and after issuing the letter of sanction referred to in clause (a), the Head of Office shall draw the amount of provisional gratuity after deducting therefrom the amount specified in of clause (a) and the dues, if any, specified in rule 45, in the same manner as pay and allowances of the establishment are drawn by him.

(4) The amount of gratuity payable under sub-rule (2) or sub-rule (3) shall, if necessary, be revised on the completion of the detailed scrutiny of the records.

(5) (a) If the amount of final gratuity had been determined by the Head of Office in consultation with the Accounts Officer before the expiry of six months from the date of retirement of a Government servant, the Accounts Officer shall direct the Head of Office to draw and disburse the difference between the final amount of gratuity and the amount of provisional gratuity paid under of clause (b) of sub-rule (3) after adjusting the Government dues, if any, which may have come to notice after the payment of provisional gratuity.

(b)(i) Where the amount of provisional gratuity disbursed by the Head of Office under sub -rule (3) is more than the amount finally assessed, the retired Government servant shall not be required to refund the excess amount actually disbursed to him.

(ii) The Head of Office shall ensure that chances of disbursing the amount of gratuity in excess of the amount finally assessed are minimized and the officials responsible for the excess payment shall be accountable for the over- payment.

(6) Where the final amount of gratuity have not been determined by the Head of Office in consultation with the Accounts Officer within a period of six months referred to in clause (a) of sub -rule (5), the Accounts Officer shall treat the provisional gratuity as final and issue authority order immediately on the expiry of the period of six months.

(7) On issue of authority order by the Accounts Officer under clause (a) of sub-rule (5) or sub-rule (6), the Head of Office shall release the amount of withheld gratuity under clause (a) of sub-rule (3) to the retired Government servant after adjusting Government dues which may have come to notice after the payment of provisional gratuity under of clause (b) of sub-rule (3).

(8) Where a Government servant is or was an allottee of Government accommodation, the withheld amount shall be paid on receipt of `No Demand Certificate’ from the Directorate of Estates.

42. Authorisation of gratuity by the accounts officer

(1) (a) On receipt of Forms for payment of gratuity referred to in rule 38, the Accounts Officer shall apply the requisite checks, record the account enfacement in Part II of Form 6 and assess the amount of gratuity and issue authority letter not later than one month in advance of the date of the retirement of a Government servant on attaining the age of superannuation.

(b) In the cases of retirement otherwise than on attaining the age of superannuation, the Accounts Officer shall apply the requisite checks, complete Part II of Form 6, assess the amount of gratuity, assess dues and issue the authority letter within three months of the date of receipt of Forms for payment of gratuity from the Head of Office.

(2) The amount of gratuity as determined by the Accounts Officer under clause (a) of sub-rule (1) shall be intimated to the Head of Office with the remarks that the amount of the gratuity may be drawn by preferring a bill to the Pay and Accounts Officer and disbursed by the Head of Office to the retired Government servant after adjusting the Government dues, if any, referred to in rule 45.

(3) The amount of gratuity withheld under sub-rule (5) of rule 46 shall be adjusted by the Head of Office against the outstanding licence fee intimated by the Directorate of Estates and the balance, if any, refunded to the retired Government servant.

43. Government servants on deputation

(1) In the case of Government servant who retires while on deputation to another Central Government Department, action to authorise gratuity in accordance with the provisions of this rule shall be taken by the Head of Office of the borrowing Department.

(2) In the case of a Government servant who retires from service, while on deputation to a State Government or while on foreign service, action to authorise gratuity in accordance with the provisions of this rule shall be taken by the Head of Office or the Cadre authority which sanctioned deputation to the State Government or to foreign service.

44. Interest on delayed payment of gratuity

(1) In all cases where the payment of gratuity has been authorised later than the date when its payment becomes due, including the cases of retirement otherwise than on superannuation, and it is clearly established that the delay in payment was attributable to administrative reasons or lapses, interest shall be paid at the rate and manner applicable to Public Provident Fund amount in accordance with the instructions issued from time to time:

Provided that the delay in payment was not caused on account of failure on the part of the Government servant to comply with the procedure laid down by the Government for processing his papers for payment of gratuity.

(2) Every case of delayed payment of gratuity shall be considered by the Secretary of the Ministry or the Department in respect of its employees and the employees of its attached and subordinate offices and where the Secretary of the Ministry or the Department is satisfied that the delay in the payment of gratuity was caused on account of administrative reasons or lapse, the Secretary of the concerned Ministry or the Department shall sanction payment of interest.

(3) The concerned Ministry or the Department shall issue Presidential sanction for the payment of interest after the Secretary has sanctioned the payment of interest under sub-rule (2).

(4) In all cases where the payment of interest has been sanctioned by the Secretary of the concerned Ministry or the Department, such Ministry or the Department shall fix the responsibility and take disciplinary action against the Government servant or servants who are found responsible for the delay in the payment of gratuity on account of administrative lapses.

Explanation. – (1) Where the payment of retirement gratuity has been delayed beyond three months from the d ate of retirement on superannuation, an interest at the rate applicable to Public Provident Fund deposits from time to time shall be paid.

(2) The delay in payment of gratuity and payment of interest therefor shall be determined in the following manner, namely:-

(i) In case of Government servants against whom disciplinary or judicial proceedings are pending on the date of retirement and in which gratuity is withheld till the conclusion of the proceedings as per rule 5,-

(a) where the Government servant is exonerated of all charges and the gratuity is paid on the conclusion of such proceedings, in such case, where the payment of gratuity has been authorised after three months from the date of his retirement, interest at the rate applicable to Public Provident Fund deposits from time to time may be allowed beyond the period of three months from the date of retirement;

(b) where the disciplinary or judicial proceedings are dropped on account of the death of the Government servant during the pendency of disciplinary or judicial proceedings, in such cases, where payment of gratuity has been authorized after three months from the date of death, interest at the rate applicable to Public Provident Fund deposits from time to time may be allowed for the period of delay beyond three months from the date of death;

(c) where the Government servant is not fully exonerated on the conclusion of disciplinary or judicial proceedings and where the competent authority decides to allow payment of gratuity, in such cases, where the payment of gratuity is authorised after three months from the date of issue of orders by the competent authority for payment of gratuity, in such cases, interest at the rate applicable to Public Provident Fund deposits from time to time may be allowed for the period of delay beyond three months from the date of issue of the above-mentioned orders by the competent authority.

(ii) On retirement other than on superannuation.- Such cases of retirement shall be either under clause (j) or clause (k) of rule 56 of the Fundamental Rules, 1922 or rules 12, 13, 16, 17 or 18 of the Central Civil Services (Implementation of National Pension System) Rules, 2021 and in such cases, where the payment of gratuity is delayed beyond six months from the date of retirement, interest at the rate applicable to Public Provident Fund deposits from time to time shall be paid for the period of delay beyond six months from the date of retirement.

(iii) On death of the Government servant while in service.- Where the payment of death gratuity is delayed beyond six months from the date of death, interest at the rate applicable to Public Provident Fund deposits from time to time shall be paid for the period of delay beyond six months from the date of death and if in any case the payment of death gratuity is held up on account of more than one claimant staking his claim to the same, such cases shall not automatically qualify for payment of interest in terms of these orders and these shall be decided in consultation with the Department of Pension and Pensioners’ Welfare.

(iv) Where the amount of gratuity already paid is enhanced on account of revision of emoluments or change in the policy relating to gratuity from a date prior to the date of retirement of the Government servant concerned and where the payment of difference of gratuity is delayed beyond a period of three months from the date of issue of the orders revising the emoluments or change in the rules, interest at the rate applicable to Public Provident Fund deposits from time to time may be allowed for the delay beyond the period of three months from the date of issue of the orders revising of emoluments or change in rules.

(v) Where the Government servant is permanently absorbed in a Public Sector Undertaking or an autonomous body otherwise than on en masse transfer on conversion of Government department or a part thereof into Public Sector Undertaking or autonomous body, and where the payment of gratuity has been delayed beyond six months from the date of such absorption, the interest at the rate applicable to Public Provident Fund deposits from time to time may be allowed for the period of delay beyond six months from the date of such permanent absorption in Public Sector Undertakings or autonomous body.

45. Recovery and adjustment of Government dues

(1) It shall be the duty of the Head of Office to ascertain and assess Government dues payable by a Government servant due for retirement.

(2) The Government dues as ascertained and assessed by the Head of Office which remain outstanding till the date of retirement of the Government servant, shall be adjusted against the amount of the retirement gratuity becoming payable.

Explanation.- (1) For the purpose or this rule, the expression `Government dues’ includes, –

(a) dues pertaining to Government accommodation including arrears of licence fee as well as damages for the occupation of the Government accommodation beyond the permissible period after the date of retirement of the allottee, if any ;

(b) dues other than those pertaining to Government accommodation, namely, balance of house building or conveyance or any other advance, overpayment of pay and allowances or leave salary and arrears of income tax deductible at source under the Income Tax Act, 1961 (43 of 1961).

Explanation.- (2) Only the Government dues as referred to in Explanation (1) shall be adjusted against the amount of retirement gratuity payable to the retired Government servant and any other dues which are not Government dues in terms of the said Explanation (1) shall not be recoverable from the amount of retirement gratuity.

46. Adjustment and recovery of dues pertaining to Government accommodation

(1) The Directorate of Estates on receipt of intimation from the Head of Office under sub-rule (1) of rule 22 of the Central Civil Services (Implementation of National Pension System) Rules, 2021 regarding the issue of No Demand Certificate shall scrutinize its records and inform the Head of Office within two months, if any licence fee was recoverable from him in respect of the period prior to eight months of his retirement and if no intimation in regard to recovery of outstanding licence fee is received by the Head of Office by the stipulated date, it shall be presumed that no licence fee was recoverable from the allottee in respect of the period preceding eight months of his retirement and no gratuity s hall be withheld.

(2) The Head of Office shall ensure that licence fee for the next eight months, that is up to the date of retirement of the allottee, is recovered every month from the pay and allowances of the allottee.

(3) Where the Directorate of Estates intimates the amount of licence fee recoverable in respect of the period mentioned in sub-rule (1), the Head of Office shall ensure that outstanding licence fee is recovered in installments from the current pay and allowances of the allottee and where the entire amount is not recovered from the pay and allowances, the balance shall be recovered out of the gratuity before its payment is authorised.

(4) The Directorate of Estates shall also inform the Head of Office the amount of licence fee for the retention of Government accommodation for the permissible period beyond the date of retirement of the allottee and the Head of Office shall adjust the amount of that licence fee from the amount of the gratuity together with the unrecovered licence fee, if any, mentioned in sub-rule (3).

(5) Where in any particular case, it is not possible for the Directorate of Estates to determine the outstanding licence fee, that Directorate shall inform the Head of Office that ten per cent. of the gratuity may be withheld pending receipt of further information.

(6) The recovery of licence fee (where it is not possible for the Directorate of Estates to determine the outstanding license fee) as well as damages (for occupation of the Government accommodation beyond the permissible period after the date of retirement of allottee) shall be the responsibility of the Directorate of Estates and the withheld amount of gratuity under sub-rule (5), the retiring Government employee, who are in occupation of Government accommodation, shall be paid immediately on production of ‘No Demand Certificate’ from the Directorate of Estates after actual vacation of the Government accommodation;

(7) The Directorate of Estates shall ensure that No Demand Certificate shall be given to the Government employee within a period of fourteen days from the actual date of vacation of the Government accommodation and the allottee shall be entitled to payment of interest (at the rate applicable to Public Provident Fund deposit determined from time to time by the Government of India) on the excess withheld amount of gratuity which is required to be refunded, after adjusting the arrears of license fee and damages, if any, payable by the allottee and the interest shall be payable by the Directorate of Estate through the concerned Accounts Officer of the Government Employee from the actual date of vacation of the Government accommodation up to the date of refund of excess withheld amount of gratuity;

(8) On account of license fee or damages remaining unpaid after adjustment from the withheld amount of gratuity mentioned under sub-rule (5), may be ordered to be recovered by the Directorate of Estates through the concerned Accounts Officer from the dearness relief without the consent of the pensioners and in such cases no dearness relief shall be disbursed until full recovery of such dues has been made.

47. Adjustment and recovery of dues other than dues pertaining to Government accommodation

(1) For the dues other than the dues pertaining to occupation of Government accommodation as referred to in clause (b) of Explanation (1) of rule 45, the Head of Office shall take steps to assess the dues one year before the date on which a Government servant is due to retire on superannuation; or on the date on which he proceeds on leave preparatory to retirement, whichever is earlier.

(2) The assessment of Government dues referred to in sub-rule (1) shall be completed by the Head of Office eight months prior to the date of the retirement of the Government servant.

(3) The dues as assessed under sub-rule (2) including those dues which come to notice subsequently and which remain outstanding till the date of retirement of the Government servant, shall be adjusted against the amount of retirement gratuity becoming payable to the Government servant on his retirement.

CHAPTER VII

Determination and Authorisation of the Amount of Death Gratuity in case of Death of Government Servant During Service

48. Obtaining of claims for death gratuity

(1) Where the Head of Office has received an intimation about the death of a Government servant while in service, he shall ascertain, –

(a) (i) if the deceased Government servant had nominated any person or persons to receive the gratuity ; and

(ii) if the deceased Government servant had not made any nomination or the nomination made does not subsist, the person or persons to whom the gratuity may be payable.

(b) The Head of Office shall, then, address the person concerned in Form 8 , for making a claim in Form 9.

(2) Where on the date of death, the Government servant was an allottee of Government accommodation, the Head of Office shall address the Directorate of Estates for the issue of No Demand Certificate in accordance with the provisions of sub-rule (1) of rule 54.

49. Completion of Form 10

(1) (a) The Head of Office while taking action to obtain claim or claims from the family in accordance with the provisions of rule 48 shall simultaneously undertake the completion of Form 10 and the work shall be completed within one month of the date on which intimation regarding the date of death of the Government servant has been received.

(b) The Head of Office shall go through the service book of the deceased Government servant and satisfy himself as to whether certificates of verifications of service for the entire service are recorded therein.

(c) (i) If there are any periods of unverified service, the Head of Office shall accept the unverified portion of service as verified on the basis of the available entries in the service book and for this purpose the Head of Office may rely on any other relevant material to which he may have ready access.

(ii) While accepting the unverified portion of service, the Head of Office shall ensure that service was continuous and was not forfeited on account of dismissal, removal or resignation from service, or for participation in strike.

(2) (a) For the purpose of determination of emoluments for death gratuity, the Head of Office shall confine the verification of the correctness of emoluments for a maximum period of one year preceding the date of death of the Government servant.

(b) In case the Government servant was on extraordinary leave on the date of death, the correctness of the emoluments for a maximum period of one year which he drew preceding the date of the commencement of the extraordinary leave shall be verified.

(3) The process of determination of qualifying service and qualifying emoluments shall be completed within one month of the receipt of intimation regarding the date of death of the Government servant and the amount of death gratuity shall also be calculated accordingly.

50. Determination of the amount of death gratuity where service records are incomplete

The service book shall be maintained properly and if in any particular case, the service book has not been maintained properly despite the instructions of the Government on the subject and it is not possible for the Head of Office to accept the unverified portion of service as verified on the basis of entries in the service book, the Head of Office shall not wait for the verification of entire spell of service and shall determine the amount of death gratuity in respect of a deceased Government servant in the following manner, namely :-

(i) if the entire service rendered by the deceased Government servant is not capable of being verified and accepted, the amount of death gratuity shall be determined on provisional basis in accordance with sub -rule (2) of rule 22 on the basis of the length of qualifying service from out of the continuous spell of verified and accepted service immediately preceding the date of death of the Government servant and the amount of death gratuity, so determined shall be authorised to the beneficiaries on provisional basis within one month of the receipt of intimation of date of death of the Government servant;