7th Pay Commission – Payment of Gratuity Bill for formal sector employees has been modified

7th Pay Commission latest news today: In a major good news for central government employees, the government recently provided a host of new benefits which will help them save massively on their retirement or when they leave a job. The showstopper was gratuity payment to central government employees under 7th Pay Commission. Centre had accepted increasing the gratuity ceiling from Rs 10 lakh to Rs 20 lakh. Further, the Payment of Gratuity Bill for formal sector employees has been modified by doubling tax-free gratuity limit up to Rs 20 lakh from previous Rs 10 lakh. Now this is a major booster for central government employees who want hefty amounts to come into their bank accounts on their retirement. Now not only they will receive more gratuity, but will also save massively on taxes. Yes, they do not have to pay large sums of money to the taxman.

A formal sector employee is the one who works for normal hours and receives regular wages. These are employees of organized sectors and are contributing to India’s gross national product (GNP) and Gross Domestic Product (GDP). They are taxed and monitored by the government.

What is Gratuity Under 7th Pay Commission?

Gratuity is given as a monetary benefit to a central government employee by the employer, however, it is not paid on a regular monthly format. Provisions and regulations of gratuities for both government and private employees are governed under the Payment of Gratuity Act, 1972.

In order to avail gratuity benefit, one must fit criteria like – eligible for superannuation, retired from the job, have resigned after completing 5 years of service in a company and finally death or disability or sickness during service period.

How is gratuity actually calculated? Check gratuity calculator below

Gratuity is calculated as tenure of service completed in a company multiplied by last drawn basic salary plus dearness allowances. Here’s an example as per ClearTax report!

For example – You worked with XYZ company for a period of 15 years. Your last drawn basic salary along with dearness allowance was Rs 30000. Hence, The amount of gratuity = 15*30000*15/26 = Rs 2,59,615

The amount of gratuity = 15*30000*15/26 = Rs 2,59,615

What has changed, when gratuities are made tax-free upto Rs 20 lakh, as per ClearTax.

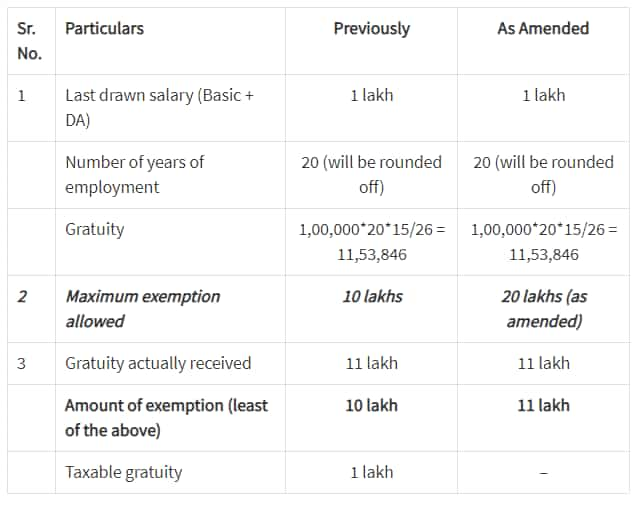

For example – The last salary drawn by Rohan is Rs.1 Lakh per month (basic + DA). He is entitled to receive a gratuity of Rs. 11 Lakhs. He has been in employment for the last 19 years and 7 months.

Check gratuity calculation table below:

From the above table it is clear that, one will not have to pay taxes on their gratuity amount upto Rs 20 lakh. Which was not the case earlier, as any gratuity amount above Rs 10 lakh was subject to income tax slabs.

It needs to be noted that, the 15/26 format is derived as 15 days salary based on the salary last drawn for every completed year of service.

In its report, ClearTax said, “The impact of the amendment is evident from the example. A hike in the ceiling limit of maximum exemption helps reduce the taxable gratuity amount. This amendment is going to benefit those earning higher salaries in the short run. However, if you have a long time left before your retirement, this amendment will benefit most employees.”

But for government employees, gratuity which are paid by the government itself are fully exempt from income taxes, as per the Income Tax Department.

Source: zeebiz