3 Schemes for Employment Linked Incentive under EPFO as part of the Prime Minister’s Package: Union Budget 2024-25 Announcement

3 Schemes for Employment Linked Incentive under EPFO as part of the Prime Minister’s Package: Union Budget 2024-25 Announcement

Ministry of Finance

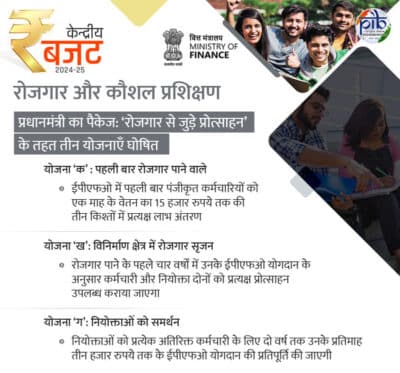

GOVERNMENT TO IMPLEMENT 3 SCHEMES FOR ‘EMPLOYMENT LINKED INCENTIVE’ AS PART OF THE PRIME MINISTER’S PACKAGE

SCHEME TO PROVIDE ONE-MONTH WAGE TO ALL PERSONS NEWLY ENTERING THE WORKFORCE IN ALL FORMAL SECTORS EXPECTED TO BENEFIT 210 LAKH YOUTH

SCHEME TO INCENTIVIZE ADDITIONAL EMPLOYMENT IN THE MANUFACTURING SECTOR LINKED TO THE EMPLOYMENT OF FIRST-TIME EMPLOYEES EXPECTED TO BENEFIT 30 LAKH YOUTH

EMPLOYER-FOCUSED SCHEME COVERING ADDITIONAL EMPLOYMENT IN ALL SECTORS EXPECTED TO INCENTIVIZE ADDITIONAL EMPLOYMENT OF 50 LAKH PERSONS

Posted On: 23 JUL 2024 1:07PM by PIB Delhi

The Government will implement 3 schemes for ‘Employment Linked Incentive’, as part of the Prime Minister’s package. These will be based on enrolment in the EPFO, and focus on recognition of first-time employees, and support to employees and employers. This was announced by Union Minister for Finance & Corporate Affairs, Smt. Nirmala Sitharaman while presenting the Union Budget 2024-25 in Parliament today. The three schemes to be implemented are as below:

Scheme A: First Timers

The Union Finance Minister said that this scheme will provide one-month wage to all persons newly entering the workforce in all formal sectors. The direct benefit transfer of one-month salary in 3 instalments to first-time employees, as registered in the EPFO, will be up to ₹ 15,000. The eligibility limit will be a salary of ₹ 1 lakh per month. “The scheme is expected to benefit 210 lakh youth”, she said.

Scheme B: Job Creation in manufacturing

The Union Finance Minister stated that this scheme will incentivize additional employment in the manufacturing sector, linked to the employment of first-time employees. An incentive will be provided at specified scale directly both to the employee and the employer with respect to their EPFO contribution in the first 4 years of employment. Smt. Nirmala Sitharaman stated that the scheme is expected to benefit 30 lakh youth entering employment and their employers.

Scheme C: Support to employers

This employer-focused scheme will cover additional employment in all sectors, said the Union Finance Minister. All additional employment within a salary of ₹1 lakh per month will be counted. The Government will reimburse to employers up to ₹ 3,000 per month for 2 years towards their EPFO contribution for each additional employee. “The scheme is expected to incentivize additional employment of 50 lakh persons”, she added.

Source: PIB

Related extract from Budget Speech:-

Outline of Scheme

1. Employment Linked Incentive Scheme

A: First Timers (Para 20)

- One month’s wage as subsidy (maximum ₹15,000)

- Applicable to all sectors

- First timers have a learning curve before they become fully productive; subsidy is to assist employees and employers in hiring of first timers.

- Applicable to all persons newly entering the workforce (EPFO) with wage/salary less than ₹1 lakh per month.

- Subsidy will be paid to the employee in three instalments

- Employee must undergo compulsory online Financial Literacy course before claiming the second instalment.

- Subsidy to be refunded by employer if the employment to the first timer ends within 12 months of recruitment.

- Expected to cover approximately one crore persons per annum.

- Scheme will be for 2 years

B: Job creation in manufacturing (Para 21)

- Applicable for substantial hiring of first time employees in the manufacturing sector

- All employers which are corporate entities and those non-corporate entities with a three year track record of EPFO contribution will be eligible.

- Employer must hire at least the following number of previously nonEPFO enrolled workers:

- 50 or

- 25% of the baseline (previous year’s number of EPFO employees) [whichever is lower]

- Incentive will be paid for four years partly to the employee and partly to the employer as follows:

| Year | Incentive (as % of wage / salary, shared equally between employer & employee) |

| 1 | 24 |

| 2 | 24 |

| 3 | 16 |

| 4 | 8 |

- Employer must maintain threshold level of enhanced employment throughout, failing which subsidy benefit will stop.

- Employee must be directly working in the entity paying salary/wage (i.e. in-sourced employee).

- Employees with a wage/ salary of up to ₹1 lakh per month will be eligible, subject to contribution to EPFO.

- For those with wages/salary greater than ₹25,000/month, incentive will be calculated at ₹25,000/month.

- Subsidy to be refunded by employer if the employment to first timer ends within 12 months of recruitment.

- This subsidy will be in addition to benefit under Part-A

- Scheme will be for 2 years

C: Support to employers (Para 22)

- Applicable to an employer who:

- Increases employment above the baseline (previous year’s number of EPFO employees) by at least two employees (for those with less than 50 employees) or 5 employees (for those with 50 or more employees) and sustains the higher level, and

- For employees whose salary does not exceed ₹1,00,000/month

- New employees under this Part need not be new entrants to EPFO

- For two years Government will reimburse EPFO employer contribution [up to] ₹3,000/month to the Employer for the additional Employees hired in the previous year.

- If the employer creates more than 1000 jobs:

- Reimbursement will be done quarterly for the previous quarter

- Subsidy will continue for the 3rd and 4th year on the same scale as Employer benefit in Part-B

- Not applicable for those Employees covered under Part-B.

- This subsidy will be in addition to benefit under Part-A.

- Scheme will be for 2 years

***

Source: PIB