New Online Income Tax Return Filing tool – File ITR-1 Assessment Year 2013-14

New user friendly Online Income Tax Return Filing tool by Income Tax Department – File ITR 1 for assessment year 2013-14 with ease

Income Tax Department has come up with a New user friendly online Income Tax Return filing tool. Unlike the tools provided earlier in which we have to fill up an offline Excel sheet, the new Income Tax tool has a neat online interface for filling up and saving data at once. Undoubtedly, the new online Income Tax Return filing facility is user friendly and professional.

We could see that presently this online tool is applicable only for ITR-1 and ITR-4S. We hope to Income Tax Department would extend this online tool to ITR-2 also in the near future.

While many of the salaried employees finished ITR filing as the deadline for the same is round the corner, some of the employees who have taxable income not more than Rs 5 lakh were waiting for income tax notification for exempting them from filing income tax return like previous years.

But income tax department has clarified that there will not be any exemption this year for salaried employees from filing income tax return. The main reason putforth by income tax department for for not extending exemption from filing income tax return is enhanced and user friendly e-filing features have been provided in the official income tax website which would facilitate all salaried employees to file their IT return online

Here is an intro to this useful tool

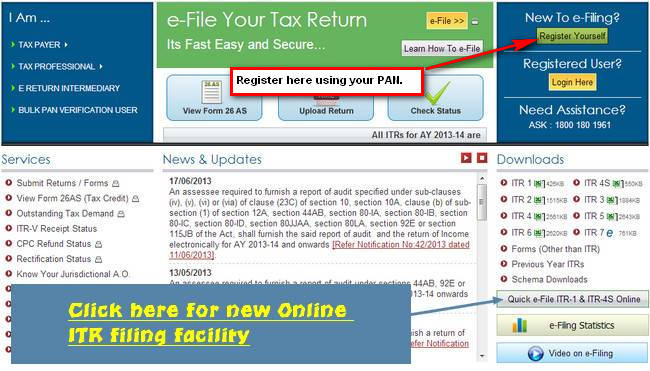

1. Go to this Income Tax Department’s Official online ITR filing Website. Register using your PAN and get user name and password, if you have not already registered.

https://incometaxindiaefiling.gov.in/

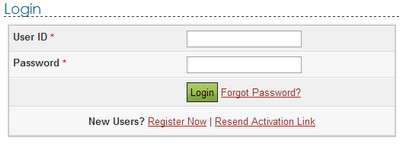

2. Login in to New Income Tax E-filing tool

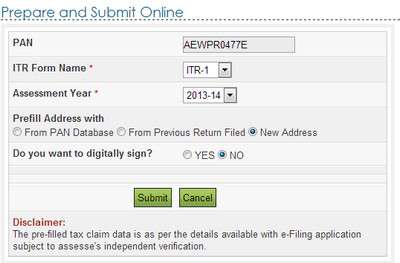

3. Once you have successfully logged in you will land in to following page

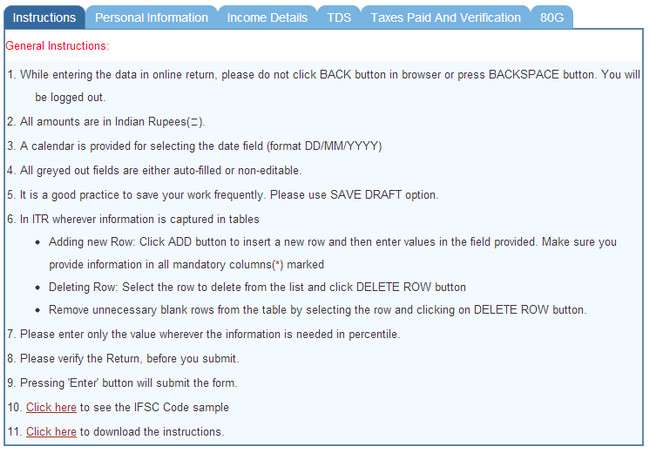

4. After you select the ITR type and relevant year for which ITR has to be filed, entry page of ITR will be shown. The first tab will be containing the instructions for filling the data

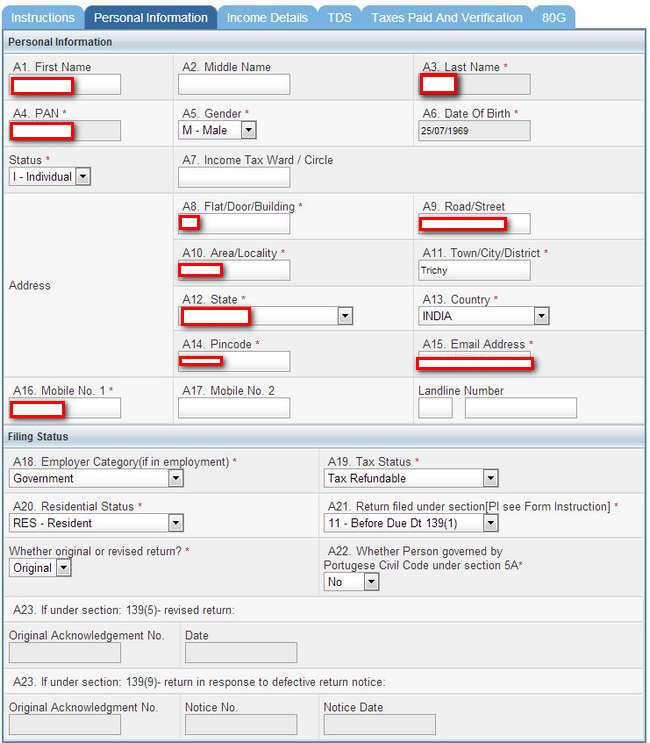

5. As you are in logged in session, it is adviceable to save the data entered after each tab is completed. However Submit Button has to be used only after entry of all the data. The following Screenshot is Personal Information entry tab. Once entry is completed save the data as draft and proceed to next tab.

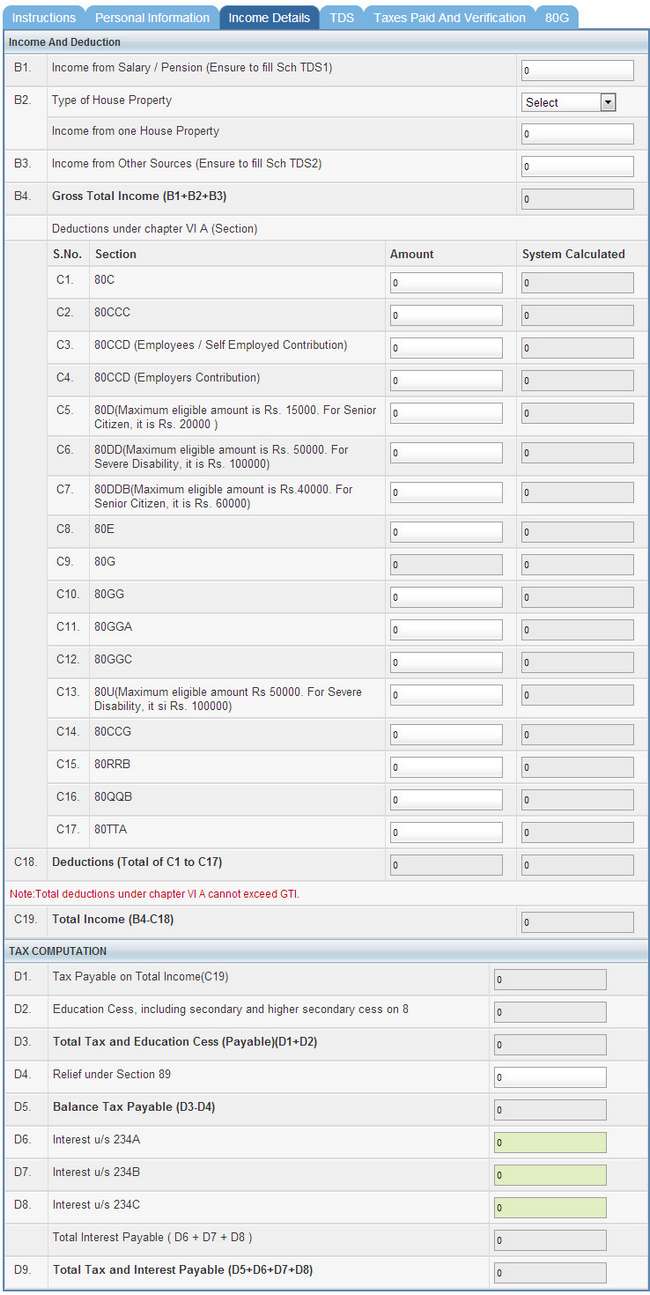

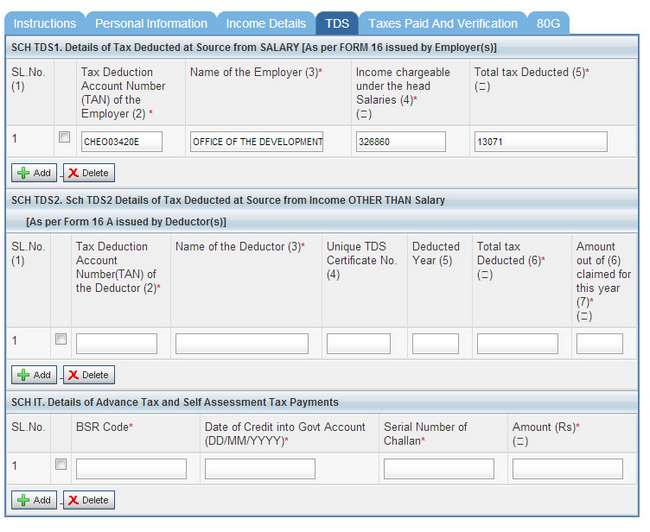

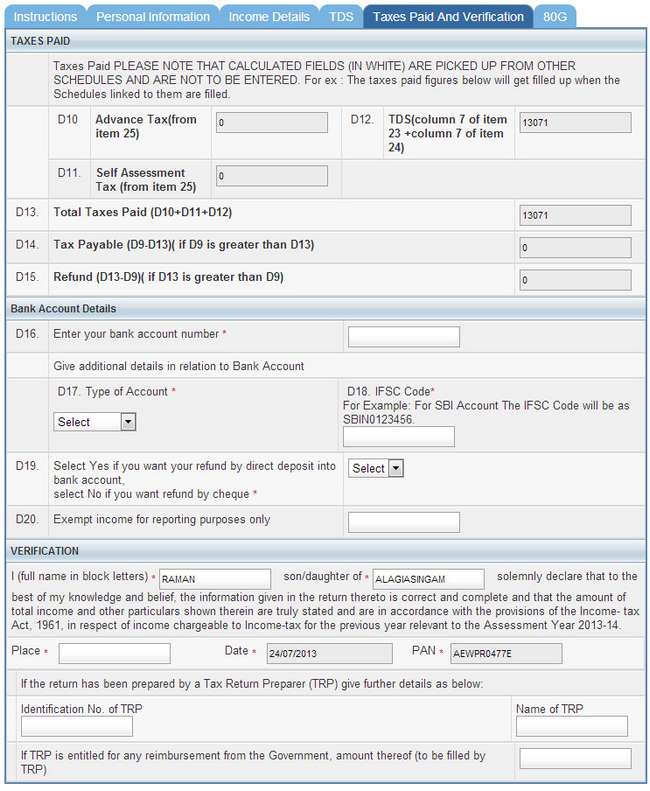

6. Following Screenshots are relating to entry tabs for Income Tax details, Details of Income Tax Deducted by employer, and Bank Account details. After entry of data in all these tabs are completed, click Submit button to generate ITR-V Button. ITR-V is a document which contains the summary of your income, deductions and income tax paid. This document has to be signed and sent to the Income Tax Central Processing Centre at Bangalore. Address of this centre will be available in the mail sent to you attaching filled up ITR-V form. Please note that Online E-filing will get completed only after receipt of this ITR-V at Central Processing Centre at Bangalore.

The following Video Tutorial has been provided by Income Tax Department for Online Income Tax Return filing