New Features and detailed tutorial for GConnect Income Tax Calculator 2012-13 (A.Year 2013-14)

How to Use the New Features added in this tool?

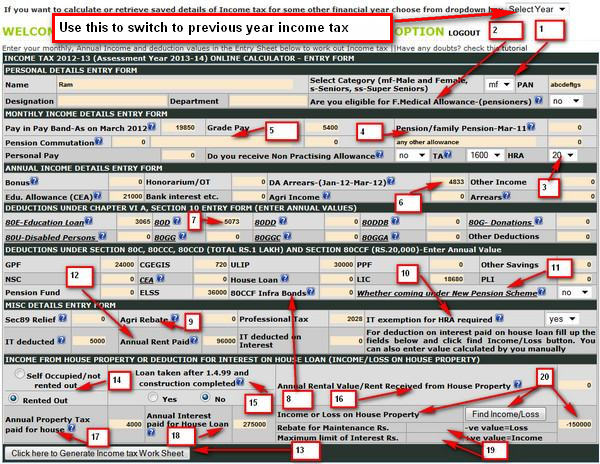

1. Income Tax calculator for all years: There is no need for switching over to income tax calculator for previous years when you want check up the detail of your previous year’s income, deductions, tax paid etc. This new version has the provision to switch over to online tool for previous years without making any additional login. Just select the year for which to need to calculate or want to see the saved values, using the drop-down menu provided on the top of the tool.

2. Now you can calculate income or loss on house property in the Income Tax calculator itself instead of of using a separate calculator provided by GConnect for this purpose. This feature was long awaited by many of the users as they wanted to save details of their house property such as income earned out of house property, annual property tax amount, Interest paid on property etc in the GConnect online income tax calculator tool itself as these details form part of our income and deductions each year. Now, we have made suitable provisions for saving these values also. The tutorial given below would reveal more about this new feature.

Go to GConnect Income Tax Calculator for Year 2012-13 (Assessment year 2013-14) and previous years

Income Tax Calculator Entry Form:

This is the tutorial for using the GConnect online income tax calculator tool 2012-13 (Assessment Year 2013-14) and previous years. Refer to the numbers marked in the picture and get the details for the same in the following tutorial

1. Category (Male & Female, Senior Citizen, Very Senior Citizen):

Select Category (Male, Female, Senior Citizen, Senior Citizen -Above 80 Years). There is no difference in tax slab for male female this year.

2. Medical Insurance:

In the case of Pensioners select yes or no for receipt of medical allowance (Rs.300 per Month)

3. NPA:

In the case of NPA, DA will also be calculated by system and will be added in the DA field automatically. So NPA entered should be exclusive of DA on NPA.

4. Pension/Family Pension:

In the case of Pensioners, the monthly Pension or family pension as on March-2011 shown in bank passbook has to be entered in this field (including DA, Fixed Medical Allowance if any).

5. Additional Fields for allowances not specified:

These are additional fields for any other allowances. Type out the name of the allowance and then enter the amount.

6. DA Arrears:

This tool calculates arrears of DA for three months (Jan-2011 to March-2011) automatically based on pay in pay band and grade pay entered by you for March-2011. If the DA arrears calculated is correct keep it as such. You can also manually enter the actual DA arrears received by you in this field. DA Arrears for the period form July to Sep 2012 need not be entered any where as the system would calculate the DA for these months in the revised rate only

7. Chapter VI A Deductions:

Click the question mark (?) specified near the descriptions for deductions (under Chapter VIA or Section 10) in this tool to get detailed income tax provisions for the relevant deduction.

8. Additional Savings under Section 80 CCF:

Enter your savings in infrastructure bonds such as IDFC during 2012-13. Maximum limit eligible for income tax deduction is Rs.20,000. This amount is in addition to eligible deduction of Rs. 1 lakh under Section 80C, 80 CCC and 80 CCD .

9. Agri Rebate:

Click on this description to get details of Agri Rebate.

10. Income Tax Exemption on HRA:

Select “Yes” if you want income tax exemption for HRA. (Those who are staying in office quarters or own house have to select “No”)

11. New Pension Scheme:

Select “Yes” if you are coming under New Pension Scheme. Contribution made by Employer will be automatically included in your income and on the deduction part, it will be deducted (up to 10% of pay+GP+DA) under Section 80 CCD(2). From the year 2010-11, this deduction will be in addition to Rs.1 lakh savings allowed under Section 80 CCE. Contribution of employee in NPS will be coming under Rs. 1 lakh limit of deduction under Section 80 CCE

12. Annual Rent Paid (To calculate amount of HRA exempted):

For calculating actual HRA exemption you have to provide here the rent (annual total amount) paid by you for the rented house. If you are residing in own house property or Office quarters, you need not enter any value here.

13. Generate Income Tax Work sheet Button:

Click the button to generate Income tax work sheet.

14. to 20. Loss or Income from House Property (Deduction for Interest paid on House Loan or adding net income earned on house property after deducting interest)

14. If you want to claim exemption/rebate for the interest paid on house loan for the house propery owned by you, select self occupied if you or your family members reside in the same. If you have rented out the property or want to declare rental value for your property selct Rented out option.

15. Under the Income Tax Act, for the purpose of computing income or loss under the head Income from House Property in respect of a self-occupied house, a deduction of Rs 30,000 is allowed against interest on borrowed capital. However, a deduction on account of interest up to a maximum limit of Rs 1.5 lakhs is available if the loan has been taken on or after April 1, 1999 for constructing or acquiring the house, and the construction or acquisition has been completed within three years from the end of the financial year in which capital was borrowed. In case the property is let out, the entire amount of interest accrued during the year is deductible.

16. The basis of calculating Income from House property is the annual value. It is not necessary, as we have seen earlier, that the property should actually be let. From the said annual value tax paid, From the annual value as determined above, municipal taxes are to be deducted. Also, deduction equal to 30% of the annual value— rent-taxpaid can be deducted as maintenance.

17. From the annual value as determined above, Tax paid on House Property can be deducted.

18. Enter the interest allowed to be deducted in respect of House loan obtained for the house property. Under the Income Tax Act, for the purpose of computing income or loss under the head Income from House Property in respect of a self-occupied house, a deduction of Rs 30,000 is allowed against interest on borrowed capital. However, a deduction on account of interest up to a maximum limit of Rs 1.5 lakhs is available if the loan has been taken on or after April 1, 1999 for constructing or acquiring the house, and the construction or acquisition has been completed within three years from the end of the financial year in which capital was borrowed. In case the property is let out, the entire amount of interest accrued during the year is deductible. This amount is considered as loss on house property and the same would deducted from the income if any from the house property. Income or loss from house property=income from house property -tax-30% of rebate for maintenance-interest allowed to be deducted.

19. Once you click the Find Income/Loss button these fields would show the amount of rebate deducted from your income on house property for the purpose of Maintenance and Maximum limit of Interest available to you for deduction. If you have self occupied your house property limit is Rs.1,50,000 or if you had taken loan prior to 1.4.99, interest limit is Rs.30,000. If you have declared the income on house property and loan was taken prior to 01.04.1999, there is no limit for deduction for interest paid on housing loan.

20. After entering all the fields coming under Income or loss on house property head, click this button to find out the Loss or income on house property. If it is a Negative value then it is a loss which will be deducted from your income while calcualting taxable income. If it is a possitive value, then it is an income for you and the same will be added while calculating taxable income. You can also enter income or loss on house property on your own in the given field when you have calculated the same manually.

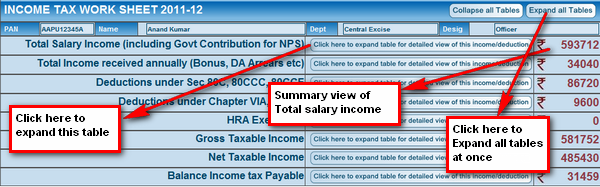

Summarised view of Income Tax Work Sheet:

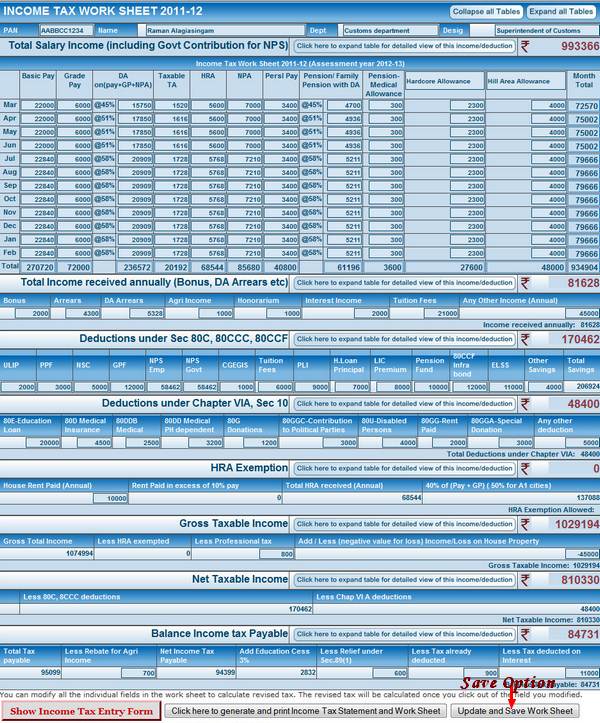

Expanded view of Income Tax Work Sheet:

All the fields in the expanded work sheet can be edited. This option is given for the purpose of changing pay or allowances in the middle of the year. Those who are promoted or transferred in the middle of the year their pay, HRA or TA may change in the middle of the year. In this situation you can edit the values relevant month of the work sheet. The tool will automatically revise the income tax once leave the field you have edited.

After you find that the all the values entered by you are correct and the income tax calculated is also corrected, click the “update and save Work sheet ” in order to save your values.

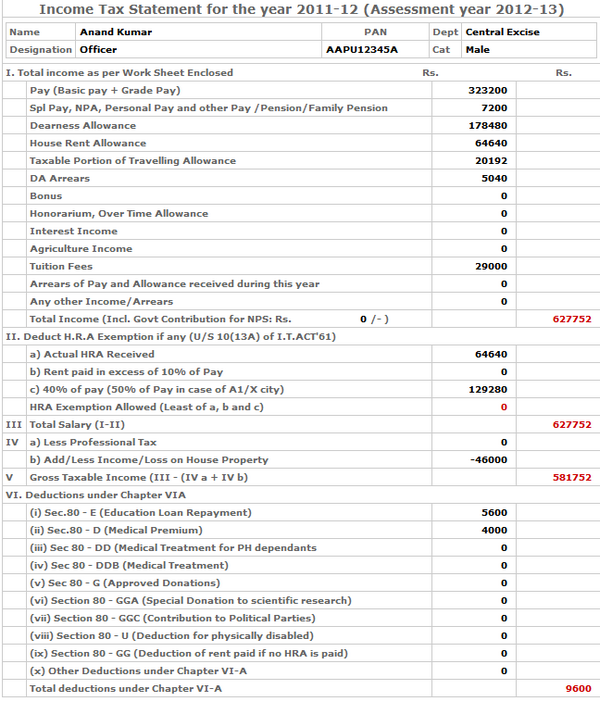

To generate printable work sheet and Income tax statement click “Generate and Print and Income tax Statement” Button. Now your your income tax work sheet and also an Income tax statement to be submitted to your employer are ready to be printed in the next window.

Go to GConnect Income Tax Calculator for Year 2012-13 (Assessment year 2013-14) and previous years