Income tax Exemption limit proposed to be raised to Rs. 3 lakh

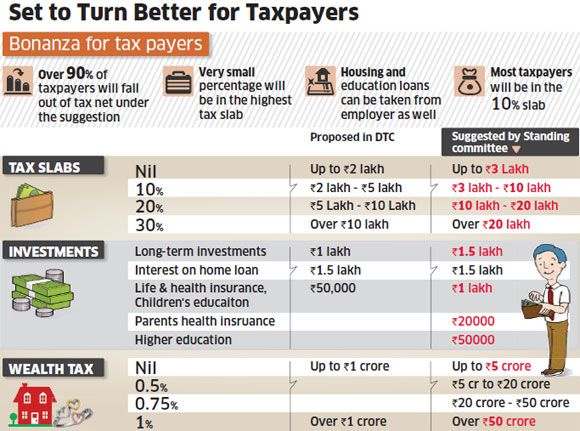

The Standing Committee on Finance on the DTC bill, headed by former finance minister Yashwant Sinha, has recommended raising the income tax exemption limit to Rs.3 lakh a year and the investment limit for tax saving schemes to Rs.3.20 lakh.

With regard to investment limit for tax saving is concerned, the committee has recommended that the proposal in the DTC for long term investments such as pension/provident funds may be raised to Rs.1.5 lakh from Rs. 1 lakh. The deduction in respect of premium on life insurance, tuition fees paid for children education, etc which are coming under a separate Rs.50,000 limit as per DTC bill has been proposed to be fixed with the maximum limit of Rs.1 lakh.

In addition to these deductions, the committee has also proposed a new deduction limit of Rs.50,000 for Higher eduction expenses. So the total deduction/savings limit, apart from interest deduction on home loan has been proposed to be fixed at Rs.3.2 lakh.

The Committee has also proposed that a 10 percent tax be levied on income between Rs.3-10 lakh, 20 percent between Rs.10-20 lakh and 30 percent on income over Rs.20 lakh.

The committee which was appointed to study the the Direct Tax Code proposals, submitted these recommendations to Lok Sabha Speaker Smt Meira Kumar last week.

The Direct Tax Code bill, if passed by Parliament this year, will replace the existing Income Tax Act.

As per the news reported in leading news papers, before enactment of Direct Tax code Government may change the Income Tax structure in the lines of these recommendations in this year Budget itself , which is to be submitted by Finance Minister on 16th March 2012.

Source: The Economic Times